Whether you are a thriving independent contractor or sole proprietor, you should choose a retirement savings vehicle that is most flexible for maximizing current tax savings. For many years the standard account used was a Simplified Employee Pension (SEP) IRA. Today, there is a more flexible account called an Individual or Solo 401(k). Let’s look at the comparison of these two accounts for solopreneurs (the self-employed with no employees).

SEP IRA

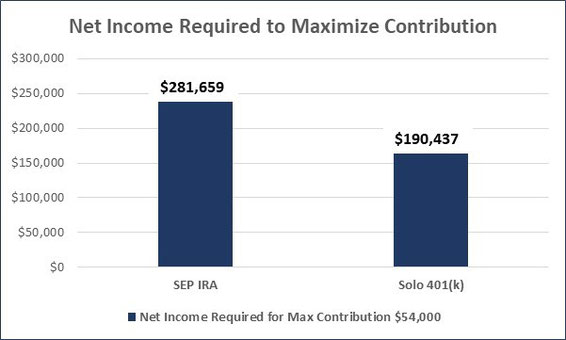

SEP IRAs are very popular because they allow you to make contributions after the calendar year and up until the filing of your tax return, even as late as the extension deadline of October 15th. They are very easy to set up as you could open one immediately and contribute for the previous calendar year if it is opened and funded before the tax deadline. Therefore, it can be very useful for last minute tax and retirement planning. The maximum contribution to the SEP IRA is $54,000 which is calculated as 25% of your net self-employed income minus your self-employment tax deduction and retirement plan contribution. This works well if you are earning net business income of $281,659 or greater as the calculation allows you to maximize your contributions. However, if your net income is less than $281,659, you are unable to maximize your contributions. This disadvantage of the SEP IRA is where the Solo 401(k) shows its greatest benefit – flexibility.

Solo 401(k)

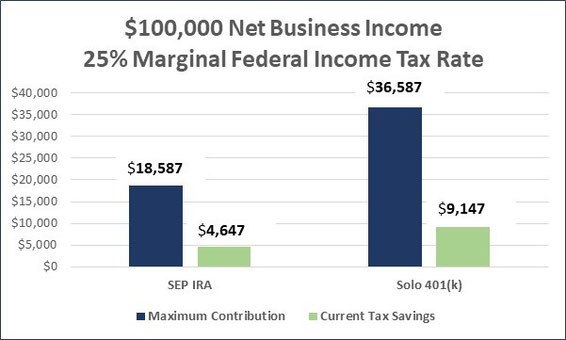

The Solo 401(k) allows solopreneurs and spouses working in the business to maximize contributions based on their level of income. Instead of only being allowed to contribute the employer side of the contribution, you are also allowed to make an employee contribution for yourself, which can be up to $18,000 in 2017 and an additional $6,000 catch-up contribution for those ages 50 and older. See below the example of a 45-year-old solopreneur with income of $100,000 showing the difference in using a SEP IRA vs. a Solo 401(k).

As you can see, the amount of contributions allowed is almost double for the Solo 401(k) vs. the SEP IRA. Assuming a 25% marginal tax bracket and maximizing contributions, your current tax savings would be $9,147 with the Solo 401(k) vs. $4,647 with the SEP IRA.

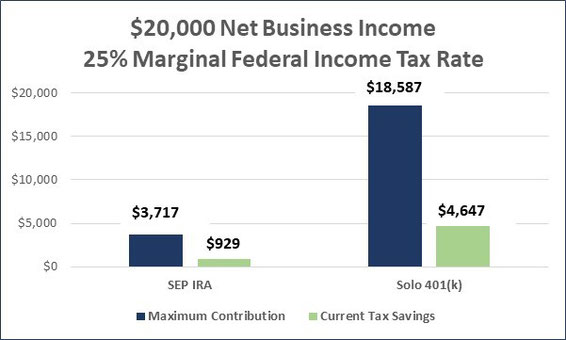

When your income is lower, such as $20,000, the maximum contribution amount is very close to your full net income amount because of the employee contributions allowed. See the example below.

Furthermore, let’s compare the amount of net income needed to maximize each account.

Obviously, you would need extra cash flow to make either of these contributions to your preferred retirement savings account. The Solo 401(k) must be opened in the tax calendar year and you need to declare your notice or intent to contribute in the form of a written note before December 31st. However, you can make contributions up until the filing date of the tax return including extensions just like the SEP IRA.

Another added advantage of utilizing a Solo 401(k) is that you can also open a Roth Solo 401(k). You do not receive tax savings on contributions but under current law you would not pay taxes when you withdraw funds in retirement. There is no income limit on making contributions to the Roth Solo 401(k) like there is for Roth IRAs. This makes the Roth Solo 401(k) a great tax-free retirement solution for solopreneurs. You can contribute up to $18,000 of employee contributions annually (+6,000 catch-up for those age 50 and older). If you make an employer contribution, it has to be made to the traditional Solo 401(k).

The Solo 401(k) has become my most highly recommended retirement savings vehicle for self-employed individuals with no employees because of the flexibility it allows in maximizing current tax savings for all levels of income. I have seen it work well for real estate agents, salespeople, and consultants. For those in higher tax brackets because of either their spouse’s additional income or investment income, the tax savings are even greater. If the Solo 401(k) is right for you, make sure to open an account before December 31 so that you can have the option to contribute for tax year 2017.

If you would like to discuss or learn more, schedule a call or meeting with me using the link below:

Tripp Yates, CPA/PFS, CFP®

901.413.8659 tripp@eaglestrong.com

Tripp's passion for financial planning is evident to each and every client he meets with. His desire is to help his clients organize finances, reduce taxes, and invest wisely. Tripp strives to work in a humble and transparent way.

Tripp has extensive experience in financial planning and investment management, and he diligently uses his credentials of CPA and CFP® to benefit his clients. Over the last ten years, he has managed over $100 million in assets for individuals and families. When he is not managing his firm and his clients, Tripp enjoys spending time with his family, running, and cheering on the Rebels and the Cubs.

References

*Calculations obtained from http://www.bankrate.com/calculators/retirement/self-employed-401-k-calculator.aspx Self-Employed 401 (k) Calculator – Individual 401 (k) Contributions.

Disclaimer

Eaglestrong Financial is a Registered Investment Advisor (RIA) with the state of Tennessee. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities.

#eaglestrong #eaglestrongfinancial