From 2006 to 2016, total employee health insurance premiums not only increased 58%, but the worker’s portion of the contribution increased 78%. Healthcare costs continue to rise while employees are becoming responsible for a larger portion of the premium payment. For these reasons, Health Savings Accounts (HSAs) have become a powerful healthcare spending tool. Over the last decade (2006-2016), the percentage of covered workers utilizing the HSA rose from 2% to 19%. For those who consider themselves relatively healthy, the HSA is a smart savings tool for not only medical expenses but also retirement. Let’s look at the key points of an HSA.

Rules:

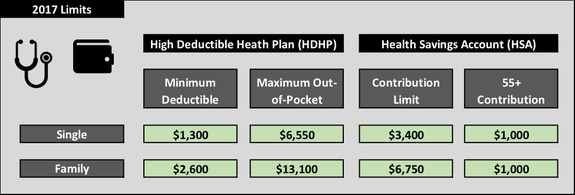

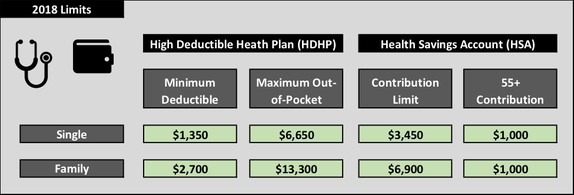

To qualify to utilize an HSA, you must use a high deductible health plan (HDHP). Although the deductibles are higher than traditional plans, the out-of-pocket expenses are capped at a maximum amount. Contributions to HSAs are tax-deductible and those age 55 and older can contribute an extra $1,000. See below for 2017 and 2018 limits.

The HDHP premiums will be much less than traditional medical premiums which have lower deductibles and out-of-pocket expenses. This premium savings with the HDHP should allow more cash flow for the average person to use to fund contributions to the HSA.

HSA Advantages:

-

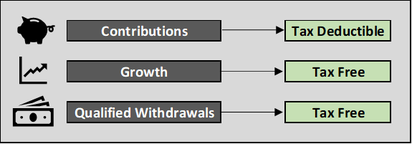

The triple tax advantage is the cornerstone of the HSA. You can deduct contributions, earnings grow tax-free, and withdrawals are tax-free if they are used for qualified medical expenses. These tax benefits can be significant over the course of many years.

- The unused account balance rolls over each year to be used in the future. You can invest the funds in the account.

- The HDHP allows you to keep insurance premiums lower vs. traditional plans resulting in more cash flow for savings.

- Beyond qualified medical expenses, you can use HSA funds tax-free for the following:

- Health insurance premiums between jobs

- Qualified long-term care insurance premiums

- Medicare premiums

- Once the HSA is established, you can keep qualified medical expense receipts that you pay out-of-pocket to utilize in the future when you need emergency funds. If you have receipts for

medical expenses you did not pay with the HSA funds, you can match them against your withdrawals tax and penalty free.

- After you turn 65, you can also use your HSA for anything without penalty but you will have to pay ordinary income tax on the withdrawal. Because of this benefit, many people use the HSA as another retirement funding vehicle in addition to a 401(k) and IRA.

- There are no income limits to make tax deductible contributions.

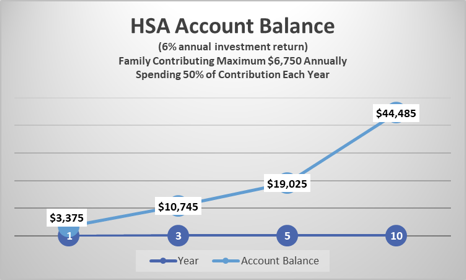

- Let’s assume you contribute the family maximum of $6,750 annually for 10 years. You spend 50% of that contribution each year for medical expenses leaving the remainder to be invested in your account. Assuming 6% annual investment return, you would accumulate $44,485 in the account after 10 years.

Areas to Note:

- You are taking on the risk that saving money now on insurance premiums will not backfire if health issues arise in the short-term that result in high medical bills. It is important to have

emergency savings in place to avoid this situation before utilizing the HDHP and HSA.

- If you have health issues, the HDHP and HSA combination is not the ideal choice. You need to be healthy for the HSA and HDHP to work. That is why they are so appealing to younger adults who

have time to build up savings in the HSA to cover deductible costs when health issues arise.

- Having a high deductible can sometimes discourage necessary health care expenses. However, this can also be a positive because it forces you to check the cost of a procedure before going

forward with unnecessary tests.

- If you make a withdrawal before age 65 for non-qualified medical expenses, you will owe tax + a 20% penalty.

You should consider a High Deductible Health Plan with an HSA if:

- You are healthy.

- You have emergency savings to cover the maximum out-of-pocket in each year.

-

You

would have the cash flow with the HDHP premium savings vs. a traditional plan to maximize your contributions to the HSA annually.

- You have plenty of cash flow or savings to pay for out-of-pocket medical expenses and are looking for additional ways to save for retirement through tax deferral.

Healthcare Reform has been a hot topic recently in the news as politicians in the House of Representatives passed legislation but no agreement could be made in the Senate.

Therefore, these changes were not implemented. However, the legislation passed in the House of Representatives included some very positive changes for HSAs that

might be a sign of what is to come in the future such as:

- Increasing the contribution maximum for the HSA to the out-of-pocket maximum which would almost double the contribution amount.

- Repealing the prescription requirement and allowing over-the-counter medications to qualify as medical expenses.

- Reducing the penalty for non-qualified HSA distributions made prior to age 65 from 20% to 10%.

We will watch closely if the healthcare reform debate resurfaces in the future. Regardless, HSAs will continue to be great savings accounts for medical expenses and retirement because of their triple tax advantage.

If you would like to discuss or learn more, schedule a call or meeting with me using the link below:

Tripp Yates, CPA/PFS, CFP®

901.619.3599 tripp@eaglestrong.com

Tripp's passion for financial planning is evident to each and every client he meets with. His desire is to help his clients organize finances, reduce taxes, and invest wisely. Tripp strives to work in a humble and transparent way.

Tripp has extensive experience in financial planning and investment management, and he diligently uses his credentials of CPA and CFP® to benefit his clients. Over the last ten years, he has managed over $100 million in assets for individuals and families. When he is not managing his firm and his clients, Tripp enjoys spending time with his family, running, and cheering on the Rebels and the Cubs.

References

https://www.zanebenefits.com/blog/2018-hsa-contribution-limits

http://www.hsacenter.com/how-does-an-hsa-work/frequently-asked-questions/

http://www.plansponsor.com/Favorable-Changes-for-HSAs-Hidden-in-GOP-Health-Care-Reform/

Disclaimer

Eaglestrong Financial, LLC is a Registered Investment Advisor offering advisory services in the states of TN and MS and in other jurisdictions where exempted. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Past performance is no guarantee of future results.

#eaglestrong #eaglestrongfinancial