Earlier today, Congress passed The Tax Cuts and Jobs Act that is labeled by some as the largest tax reform in decades. I was fascinated last weekend as the details of the agreement were made public. A last-minute change including allowing a 20% income deduction on qualified business income for pass-through businesses (sole proprietors, partnerships, LLCs, & S-Corps), even those that are service related under income thresholds of $157,500 (single) or $315,000 (married filing jointly), was the biggest surprise. Initially, the 20% deduction was going to leave out service related pass-through businesses altogether. I have been reading articles daily on tax reform, but the best I have found are from Michael Kitces, probably the smartest advisor in our business and co-founder of the XY Planning Network of which I am a member, and the Journal of Accountancy. Both of these articles provided tremendous detail on the legislation, but I am going to give you what I believe are the key points.

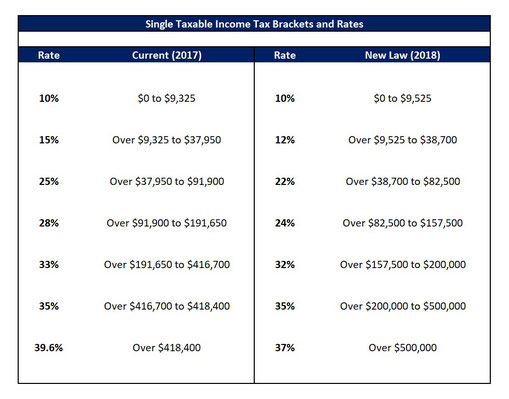

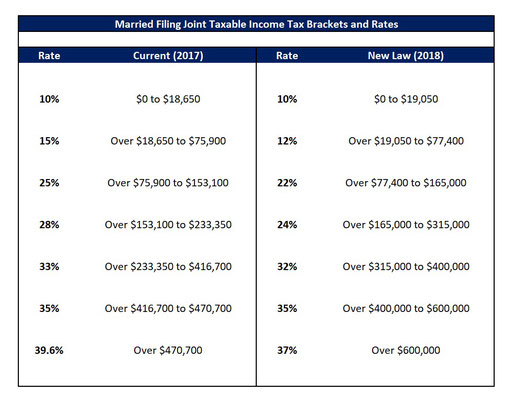

Tax Rates

Most tax brackets saw a decrease in the tax rate by a few percentage points.

Capital Gains Rates

Going forward in 2018, the favorable capital gains and qualified dividend tax rates will continue to be 0%, 15%, or 20% based on your taxable income. Only those with taxable income over $452,400 (single) or $479,000 (married filing jointly) will be subject to the 20% rate.

The 3.8% Medicare surtax on net investment income will remain with adjusted gross income (AGI) thresholds of $200,000 (single) and $250,000 (married filing jointly).

Personal Exemptions and Standard Deduction

The current personal exemption of $4,050 per individual family member is going away. Instead, the new law almost doubles the standard deduction from $6,350 to $12,000 for individuals and from $12,700 to $24,000 for married couples filing jointly. This increased standard deduction may negate itemized deductions that do not add up to more than the standard deduction amount for many people. Common itemized deductions are property taxes, mortgage interest, and charitable gifts to name a few.

Other Notable Deduction Changes

· Mortgage Interest: For new mortgages taken out after December 15th 2017, the deductibility of mortgage interest on debt principal decreases from $1,000,000 to $750,000. However, any existing mortgages will retain their deductibility of interest on the first $1,000,000.

· Home Equity Indebtedness: Starting in 2018, interest on home equity loans or lines of credit (even cash outs from a traditional mortgage) where the money is used for any purpose other than to acquire, build, or substantially improve the primary residence will no longer be deductible. This applies to both existing and new home equity loans or lines of credit.

· State & Local Income Tax and Property Tax: The new law will limit the deduction on combined state and local income and property taxes up to a $10,000 total. This $10,000 limit applies both to individuals and married couples filing jointly.

· Medical Expenses: Retroactively for 2017 as well as for 2018, medical expense deductions are reduced to 7.5% of adjusted gross income (AGI) but revert back to 10% of AGI in 2019.

· Miscellaneous Itemized Deductions: These deductions which have been subject to deductibility only above 2% of your AGI will no longer be allowed. These items include tax preparation expenses, unreimbursed employee expenses, investment advisory fees, and safety deposit box fees.

Child Tax Credit

The Child Tax Credit has been expanded from $1,000 per qualifying child under the age of 17 to $2,000. Additionally, the income phaseout thresholds for the credit have been substantially increased from $75,000 to $200,000 for individuals and from $110,000 to $400,000 for married couples filing jointly. This increase in the child tax credit may more than make up for the lost personal exemption for each child for large families within the income thresholds. High-income families ($400,000 married couples filing jointly and $200,000 individuals) are phased-out of the child tax credit but were likely already being phased-out of personal exemptions under the current law.

529 College Savings Plans

Tax-free distributions from 529 Plans have been limited to qualified higher education (college) expenses in the past. The new law expands tax-free distributions to be used for private elementary and secondary school expenses up to $10,000 per student each year. Initially, the tax-free distributions included homeschooling expenses but that part, specifically, was taken out of the legislation before final approval.

Estate Tax

Starting in 2018, the estate tax exemption will be increased to $11,200,000 (individuals) and $22,400,000 (married couples). This is an increase from the $5,600,000 individual exemption that was scheduled for 2018.

20% Deduction on Qualified Business Income for Pass-Through Entities

As mentioned above, pass-through entities include sole proprietorships, partnerships, LLCs, and S corporations. Basically, these businesses will be taxed on only 80% of their pass-through income. For service related businesses, the deduction will be limited to those with taxable income below $157,500 (single) and $315,000 (married filing jointly). For service business owners with income that exceeds these thresholds, a phase-out of the deduction will occur for the next $50,000 of income for individuals and $100,000 for married couples filing jointly. Specifically, engineers and architects (even though service related) are allowed the deduction without being subject to the income threshold.

Qualified business income does not include “reasonable compensation” to an S corporation owner-employee or guaranteed payment for services in a partnership or LLC.

Corporations

Perhaps the most significant change in tax reform was reducing the corporate tax rate from 35% to 21%. Additionally, U.S. corporations will be encouraged to bring back profits that have been held overseas with a one-time tax up to 15.5%.

There are more changes in the law but hopefully these key points will give you some insight into what tax reform means for you. We encourage you to consult with your CPA or tax preparer so that you will be prepared for the upcoming changes.

If you would like to discuss or learn more, schedule a call or meeting with me using the link below:

Tripp Yates, CPA/PFS, CFP®

901.619.3599 tripp@eaglestrong.com

Tripp's passion for financial planning is evident to each and every client he meets with. His desire is to help his clients organize finances, reduce taxes, and invest wisely. Tripp strives to work in a humble and transparent way.

Tripp has extensive experience in financial planning and investment management, and he diligently uses his credentials of CPA and CFP® to benefit his clients. Over the last ten years, he has managed over $100 million in assets for individuals and families. When he is not managing his firm and his clients, Tripp enjoys spending time with his family, running, and cheering on the Rebels and the Cubs.

References

- https://www.wsj.com/articles/congress-is-on-brink-of-tax-overhaul-1513732560

Disclaimer

Eaglestrong Financial, LLC is a Registered Investment Advisor offering advisory services in the states of TN and MS and in other jurisdictions where exempted. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Past performance is no guarantee of future results.

#eaglestrong #eaglestrongfinancial