While investor behavior is arguably the biggest factor in investor returns, we believe asset allocation is of utmost importance. This is basic investment knowledge, but sometimes simplicity is impactful to our understanding of investing.

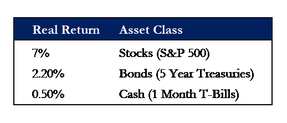

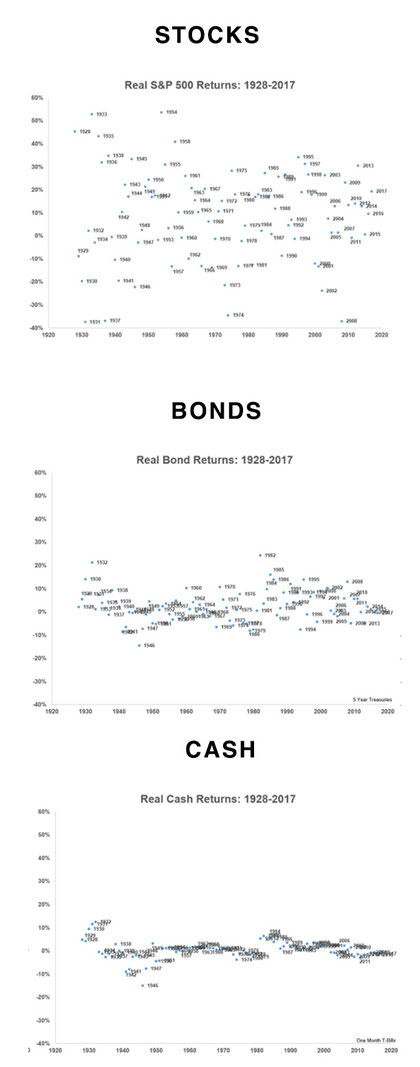

Real investment returns are investment returns minus the inflation rate. The average annual inflation rate has been around 3% (1928-2017) while the approximate real annual returns of stocks, bonds, and cash have been:

To give perspective, Ben Carlson charted the yearly real returns of these three asset classes in the charts below. Stock returns are all over the place. Bond returns have moderate volatility and cash return fluctuations are limited. However, when looking back at the difference in the annualized returns of the different asset classes over history noted above, you see that those investors that have endured the most uncertainty in stocks have been rewarded with the highest investment return.

“If you want more predictability in the short-term, you have to live with lower long-term returns. And if you want higher long-term expected returns, you have to learn to live with more volatility in the short-term.” Ben Carlson

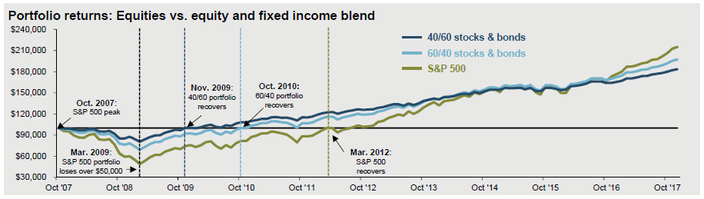

This is where asset allocation comes into play. By adding bonds to your portfolio, you reduce the volatility which helps to keep investor behavior on track. Let’s take a look at the downturn and ensuing recovery after the financial crisis in 2008. How long did it take different asset allocations to recover from the market bottom in March 2009 to the previous high in October 2007?

However, you can clearly see that 10 years after the financial crisis, 100% stocks led the way in portfolio returns as they have over history. All this to say, it is important to develop a goals-based investment approach that is supported by your financial plan with an asset allocation that you can stick with over the long-term. By doing this, you will have the proper risk/reward expectations to endure the ups and downs in the market. A common approach is to have a more aggressive portfolio when you are in your early working years and get more conservative as you approach retirement. Even still, a sizable allocation to stocks is needed, in most cases, during retirement to keep up with rising costs (inflation). Understanding your asset allocation is a major part of successful long-term investing.

Our goal at Eaglestrong is to guide, inspire, and educate our clients to be financially wise. If you would like to discuss or learn more, schedule a call or meeting with me using the link below:

Tripp Yates, CPA/PFS, CFP® 901.413.8659 tripp@eaglestrong.com

Tripp's passion for financial planning is evident to each and every client he meets with. His desire is to help his clients organize their finances, save taxes, and invest wisely. Tripp strives to work in a humble and transparent way.

Tripp has extensive experience in financial planning and investment management, and he diligently uses his credentials of CPA and CFP® to benefit his clients. Over the last ten years, he has managed over $100 million in assets for individuals and families. When he is not managing his firm and his clients, Tripp enjoys spending time with his family, running, and cheering on the Rebels and the Cubs.

References

J.P. Morgan Asset Management – Guide to the Markets 3Q 2018

https://smartasset.com/investing/inflation-calculator

Disclaimer

Eaglestrong Financial is a Registered Investment Advisor (RIA) with the state of Tennessee. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Past performance is no guarantee of future results.

#eaglestrong #eaglestrongfinancial