Last week volatility in the markets returned. News stories surrounding the China Trade talks, U.S. Fed policy on interest rates, and the status of the economy overall were blamed at one time or another. The headlines were flashing orange with how many points the market dropped as the media knows that grabs attention. Anyone that follows our thoughts on investing knows that we believe it is wise to not pay attention to the noise in the news headlines.

The reality is that we all participate and invest in the markets to get investment returns. In order to get investment returns over the long-term, we will be subject to volatility. That is why, historically, a higher return is achieved in stocks and bonds vs. cash over the long-term. There will be periods where markets underperform and prices fall; that is part of the process. But never lose focus on why you are investing. It is to achieve the long-term investment return to accomplish your financial planning goals. That may be annualized returns of 6%, 7%, or 8% depending on your specific plan. For some, you may only need 5% and are afforded the ability to keep more of your money in cash equivalents with lower returns and minimal volatility.

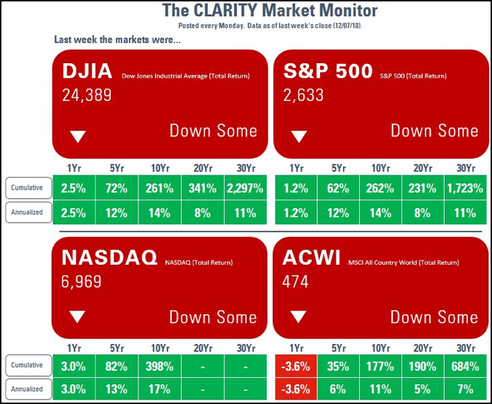

For a clearer picture, what if the news illustrated the movement in the markets each week with a longer-term perspective. The CLARITY Market Monitor in the chart below does just that. It keeps things in perspective.

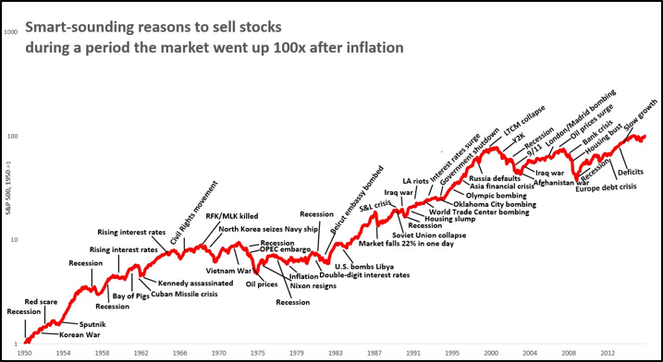

There have been and will always be negative headlines that give us reasons not to invest. The chart below shows the most publicized reasons going back to 1950 while the U.S. market (S&P 500) continued its long-term trend upward. We have the choice of what we listen to and focus on.

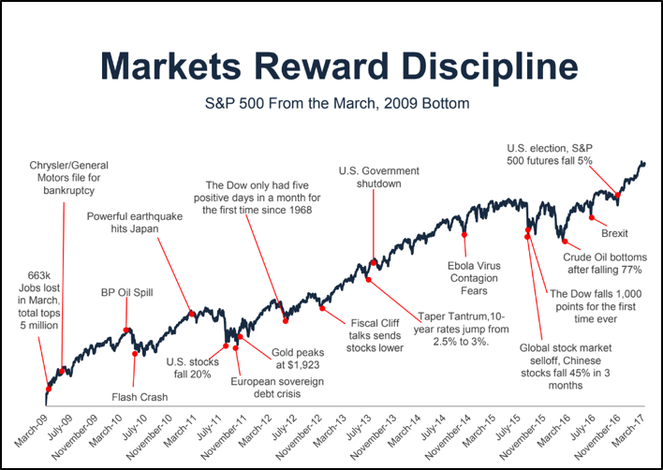

For an even shorter period of time that might be clearer in your memory. The chart below goes back to the current recovery since March of 2009. The negative news and upward trend of the market is the same.

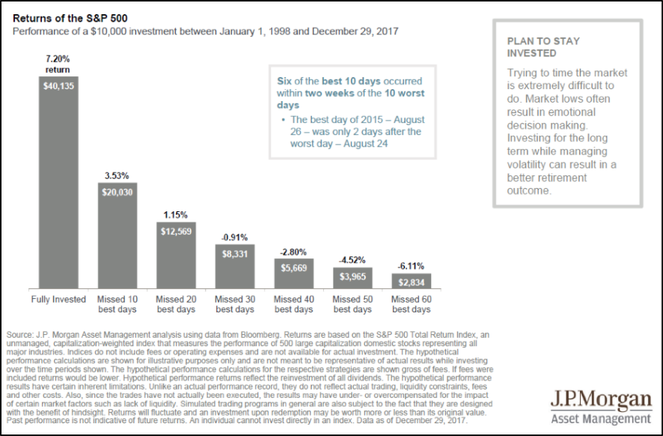

While giving perspective, I do not overlook or minimize the anxiety and frustration that a downturn in the market causes us to feel. That is why we always have to go back to our long-term plan. That is why we plan. Otherwise we subject ourselves to trying to time the market and that does not have good implications for your plan. As the chart below shows, only missing the best 20 days in the U.S. stock market (1998 – 12/29/2017) would have caused the annual investment return to be 1% vs. 7%. That is a big difference. Not only that, six of the best 10 days occurred within two weeks of the 10 worst days. The bottom line – stay the course and stick to your long-term plan.

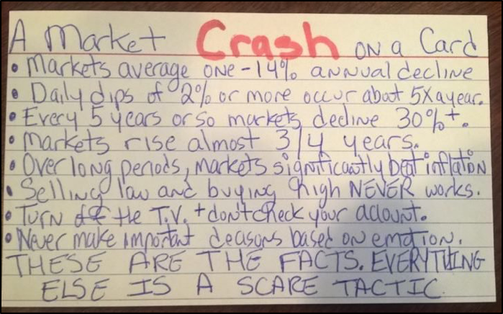

One advisor came up with a simple way to keep our emotions in check during periods of downturn in the market. He fit his key points all in a note card. It’s simple but it provides the context we need.

At Eaglestrong, we are here to help you stay focused on the long-term. We will endure great market advances as well as declines but know it is our mission to keep you focused on your plan. We believe emotions and behavior may be the biggest factor in achieving your overall investment success. My current list of books to read includes The Behavioral Investor.

I look forward to sharing my highlights from the book soon. Click here for more information on our investment philosophy.

If you would like to discuss or learn more, schedule a call or meeting with me using the link below:

Tripp Yates, CPA/PFS, CFP®

901.413.8659 tripp@eaglestrong.com

Tripp's passion for financial planning is evident to each and every client he meets with. His desire is to help his clients organize finances, reduce taxes, and invest wisely. Tripp strives to work in a humble and transparent way.

Tripp has extensive experience in financial planning and investment management, and he diligently uses his credentials of CPA and CFP® to benefit his clients. Over the last ten years, he has managed over $100 million in assets for individuals and families. When he is not managing his firm and his clients, Tripp enjoys spending time with his family, running, and cheering on the Rebels and the Cubs.

References

https://twitter.com/ConcentusWealth/status/1072153303797153792

https://twitter.com/morganhousel/status/1070034783911198720

http://blairbellecurve.com/crisis-du-jour/

J.P. Morgan Asset Management – Guide to the Retirement 2018 Edition page 40

Disclaimer

Eaglestrong Financial, LLC is a Registered Investment Advisor offering advisory services in the states of TN and MS and in other jurisdictions where exempted. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Past performance is no guarantee of future results.

#eaglestrong #eaglestrongfinancial

Share with others: