Realizing that stories are powerful to all of us, we thought we would take a look back at some milestones in my life intertwined with investing in the markets. We can talk about historical returns but for some reason if we relate them to our own milestones the information becomes more meaningful.

For purposes of “the stock market,” we used historical S&P 500 (500 largest US stocks) data from Yale professor Robert Schiller through February 15, 2019. We believe in global diversification, but for this exercise the Schiller S&P 500 historical data was the most readily available. We also assumed that all dividends were reinvested. Lastly, we used a start date for the closest month surrounding the milestones in my life.

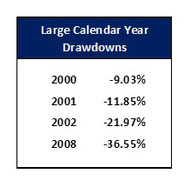

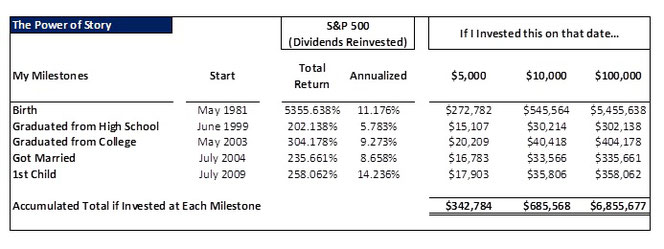

I was born in 1981 and will turn 38 this year. $5,000 invested in the market when I was born would have turned into $272,782. $10,000 invested would now be $545,564. $100,000 invested would be a whopping $5,455,638. You get the picture. Even though I know the history of the market, these numbers are mind blowing. I realize 38 years is a long time, but it makes me think how inspiring this could be to parents/grandparents to invest a small amount of money when their children/grandchildren are born. In the same way, it encourages those just starting their careers to save early even if it is a small amount. Looking at these numbers reminds us that “time in the market” versus trying to “time the market” is what really pays off. It is also important to point out there were some tough years of losing money to get to today.

On the flip side, the market has been positive 31 out of the 38 years that I have been alive. That is approximately 82% of the time. This is meaningful considering the daily volatility and constant negative headline news we encounter.

Looking at other milestones in my life such as graduating from high school and college, getting married, and having our first child all paint the same picture. The time period is shorter and returns vary, but they are all interesting because they are dates that are meaningful to my life. Ironically, the shortest time period of investing has the highest annualized rate of return of 14%. This is because my first child was born in 2009 right after the financial crisis.

Another view of these numbers shows us that if I had invested $5,000 at each of the five different milestones from my birth to my first child being born, the total investment out of my pocket would have been $25,000. It would now be worth $342,784.

So, what does all this mean? I believe it shows that it pays to be optimistic. History does not tell us what the future holds, but it can be instructional nonetheless. If story can inspire someone to save, invest, or stay invested then it is no doubt powerful.

If you would like to discuss or learn more, schedule a call or meeting with me using the link below:

Tripp Yates, CPA/PFS, CFP®

901.413.8659 tripp@eaglestrong.com

Tripp's passion for financial planning is evident to each and every client he meets with. His desire is to help his clients organize finances, reduce taxes, and invest wisely. Tripp strives to work in a humble and transparent way.

Tripp has extensive experience in financial planning and investment management, and he diligently uses his credentials of CPA and CFP® to benefit his clients. Over the last ten years, he has managed over $100 million in assets for individuals and families. When he is not managing his firm and his clients, Tripp enjoys spending time with his family, running, and cheering on the Rebels and the Cubs.

References

https://us.dimensional.com/perspectives/why-should-you-diversify

https://dqydj.com/sp-500-return-calculator/

http://www.econ.yale.edu/~shiller/data.htm

http://people.stern.nyu.edu/adamodar/New_Home_Page/datafile/histretSP.html

Disclaimer

Eaglestrong Financial, LLC is a Registered Investment Advisor offering advisory services in the states of TN and MS and in other jurisdictions where exempted. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Past performance is no guarantee of future results.

#eaglestrong #eaglestrongfinancial

Share with others: