The majority of our focus when dealing with our money is on our spending and savings. Our common view is that we will save over a long career to build up our 401k and other investment accounts so that we can retire one day. This is necessary and wise but there is much more to gain in looking at our values and linking them to our money decisions. This thought of combining our values and money is referred to as “life planning.” George Kinder, an advisor and speaker, has been labeled the “father of life planning.” He developed three questions to help those he worked with become clear on what is important to them. I think you will find that answering these questions can energize you to get a clearer picture of why you work and save and retire with purpose. It will also give you a list of goals that you can accomplish over time.

|

Question #1: Dreams

I want you to imagine that you are financially secure, that you have enough money to take care of your needs, now and in the future. The question is, how would you live your life? What would you do with the money? Would you change anything? Let yourself go. Don’t hold back your dreams. Describe a life that is complete, that is richly yours. |

This question should outline your dreams. Maybe you would travel the world or buy a vacation home. You might already have a list of things you would do if you just had the money saved up. Are there important charities or causes that you would like to support? For some, just having the financial freedom to go anywhere at anytime would bring joy.

Have you seen the movie “The Family Man?” I can’t help but think of Jack Campbell (Nicholas Cage) at the beginning of the movie with his Ferrari, penthouse and that amazing closet…

If you were financially secure and could dream big, those would be some fun things to add to your list. Jack Campbell thought he had everything he needed…enter plot twist. Remember what happens next? The glimpse into what his life would have looked like without those unlimited resources.

|

Question #2: Bucket List

This time, you visit your doctor who tells you that you have five to ten years left to live. The good part is that you won’t ever feel sick. The bad news is that you will have no notice of the moment of your death. What will you do in the time you have remaining to live? Will you change your life, and how will you do it? |

This question forces you to seize the day. You have time to travel places or accomplish goals. You can visit and spend more time with family, friends and others that have made a meaningful impact on your life. Most likely, you will not have an unlimited amount of money to do all the things you dreamed of in answering question #1. However, the focus shifts from dreams to things that have meaning in your life.

OK back to the movie. Jack is in the middle of his “glimpse.” He is horrified at first…mini-van instead of Ferrari, suburban home instead of the penthouse suite, knock-off suits instead of a fine closet full of clothes, and of course nasty diapers and crazy kids that he never had to deal with before.

He cannot figure out how he and his “wife” are still madly in love while living this way and how his family could be so happy. We know he ends up coming around to the idea, but then the glimpse is over.

How can you use this example to help come up with your bucket list if you only had 5-10 years remaining? Think of Jack Campbell, the family man without unlimited resources, and what he would have enjoyed doing. He apparently was great at surprising his wife with anniversary gifts and serenading her at her birthday party. I imagine that they would have taken fun family trips and figured out creative ways to make special memories even on a budget.

|

Question #3: Relationships

This time, your doctor shocks you with the news that you have only one day left to live. Notice what feelings arise as you confront your very real mortality. Ask yourself: What dreams will be left unfulfilled? What do I wish I had finished or had been? What do I wish I had done? What did I miss? |

This question leads me to think of those that I have the closest relationship with. My family and friends. I imagine many of you will have the same feelings. Answering the questions of what you will not be able to do or accomplish will crystalize your life goals.

The movie shows us exactly what Jack did with his “one day.” He caught his “wife” at the airport and begged her to miss her flight so that they could just have coffee and he could share the glimpse of what their life could be if they chose to be together.

None of the material things Jack Campbell had were bad things. I think it’s great to dream big and have goals. I also think the second and third questions are vital to ask yourself so that you can keep your focus on the relationships that matter most to you. Enjoy the big dreams and also appreciate the little, everyday moments.

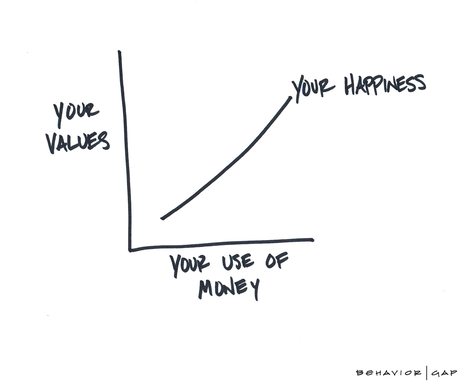

While numbers are important and many like myself enjoy working with them, aligning your values with your money can be transformational to energizing you. Whether fulfillment in your work, purpose in your retirement, satisfaction in your spending or confidence in your saving, these three questions should give you a blueprint to build the life you desire.

If you would like to discuss or learn more, schedule a call or meeting with me using the link below:

Tripp Yates, CPA/PFS, CFP®

901.413.8659 tripp@eaglestrong.com

Doty Yates, CPA

901.619.3599 doty@eaglestrong.com

Tripp and Doty are a husband/wife financial planning team based in Memphis, TN. Their desire is to help clients organize finances, reduce taxes, and invest wisely.

References

The Family Man (2000) https://www.imdb.com/title/tt0218967/

https://www.kinderinstitute.com/

Disclaimer

Eaglestrong Financial, LLC is a Registered Investment Advisor offering advisory services in the states of TN and MS and in other jurisdictions where exempted. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Past performance is no guarantee of future results.

#eaglestrong #eaglestrongfinancial

Share with others: