September is life insurance awareness month. While we don’t sell life insurance, we do analyze the type of coverage and the amount needed based on your age, income, assets, and family size. By not selling life insurance, we are able to give our clients unbiased advice to obtain necessary and adequate coverage. Especially for young families, life insurance is an important part of the overall financial plan.

1. How much coverage should you have?

A common rule of thumb is to obtain life insurance coverage for 10x your income. However, the amount of coverage a young earner with a family needs is 15-20x their income. For example, if your annual income is $150,000, then you would obtain $3,000,000 in coverage. The idea is that the beneficiary of your life insurance could invest the benefit and withdraw 5% annually which would equate to $150,000 to replace the income. This is by no means a perfect analysis but it is a quick “back of the envelope” way to estimate the amount of coverage you need.

If you have had time to accumulate investment and/or retirement assets, then it is likely that you would require less coverage. In the same way, if you save a lot of your income then the amount of coverage you need may focus more on your spending instead of income. Dual income in households can also impact the coverage calculation. The general idea is that as you approach retirement and/or no longer have minor children, the need for life insurance goes away.

Other factors that can affect the amount of coverage needed:

- Spousal Coverage: If only one spouse works outside the home and you have young children, it is important to have coverage for the stay at home spouse to account for the cost of care for your children. For example, $500,000 received as a life insurance benefit and invested would equate to around $25,000 annual sustainable spending for childcare.

-

Business Owners: For those with ownership in a business, it is important to consider additional life insurance for a couple of reasons:

-

- Pay off associated business debts

- If you have partial ownership, life insurance provides a way for the other partners or owners to pay your beneficiary your ownership share

- Pay off associated business debts

2. What are the policy types?

The two main types of life insurance are term and whole life.

-

Term: This policy is straightforward life insurance coverage for a specified term such as 10, 20 or 30 years. At the end of the term, the life insurance is no longer in

force.

- Whole Life: This policy tends to be more expensive because it remains in effect for your “whole life.” Usually, it will have a cash value associated that you can receive if you terminate the policy. You can also take loans from the policy cash value.

We recommend term life insurance for our clients because we encourage getting the most coverage at the lowest cost. There may be unusual times where whole life insurance makes sense for a specific client, but term insurance is optimal the majority of the time.

3. What does coverage cost?

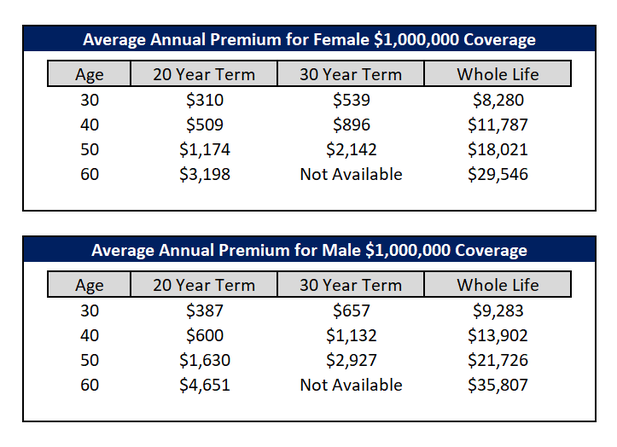

Selecting the type of policy and term coupled with your age and health will determine the cost. We’ve included some estimates below (from Quotacy) to give you an idea of the cost at the age of purchase.

If you are a member of a professional organization for your occupation, check to see what rates they have available. For example, because I’m a CPA and a member of the American Institute of Certified Public Accountants I can purchase life insurance through that group. I have also worked with dentists who are able to purchase coverage through the American Dental Association. Many times, the member groups rates are lower than other coverage providers. Also, your employer may offer group coverage up to 3 times your salary.

Ensure you have adequate and cost-effective coverage in place. The younger and healthier you are, the lower the cost of insurance. If we can help you analyze your life insurance, let us know.

Tripp Yates, CPA/PFS, CFP®

901.413.8659 tripp@eaglestrong.com

Tripp’s passion for financial planning is evident to each and every client he meets with. His desire is to help his clients organize their finances, reduce taxes, and invest wisely. As a fee-only fiduciary advisor, Tripp strives to work in a humble and transparent way.

With extensive experience in financial planning and investment management, Tripp diligently uses his credentials of CPA and CFP® to benefit his clients. Over the last ten years, he has managed over $100 million in assets for individuals and families. In 2017, he founded Eaglestrong Financial, specializing in helping dentists and business owners. Outside of work, Tripp enjoys running, spending time with his family, and cheering on his favorite sports teams. He is an active member of Harvest Church.

References

https://www.nerdwallet.com/blog/insurance/average-life-insurance-rates/

Disclaimer

Eaglestrong Financial, LLC is a Registered Investment Advisor offering advisory services in the states of TN and MS and in other jurisdictions where exempted. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Past performance is no guarantee of future results.

#eaglestrong #eaglestrongfinancial

Share with others: