The SECURE Act became effective January 1, 2020 and has implications for retirement accounts and estate planning. I’ll highlight the key changes and how they may affect financial planning going forward.

The Stretch IRA has been eliminated for most people:

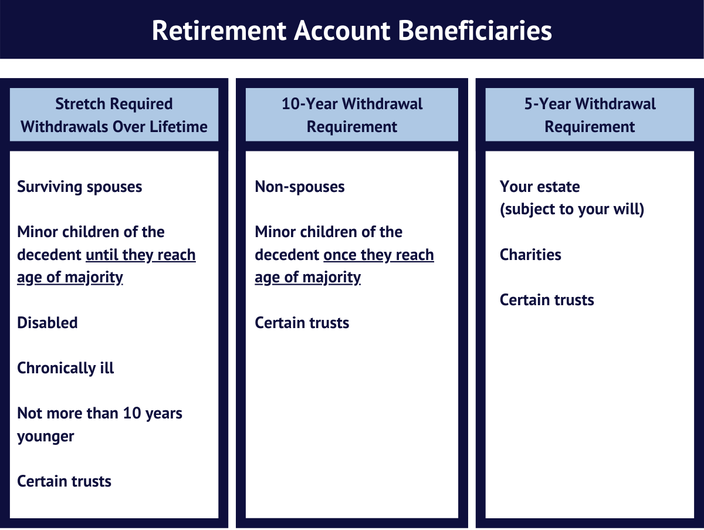

Your children or other non-spouse beneficiaries can no longer inherit an IRA and withdraw minimum amounts each year over their lifetimes. Starting January 1, 2020, the money in these IRAs will have to be withdrawn within a 10-year period. Keep in mind the benefit of a stretch IRA was to allow the beneficiary to let the IRA continue to grow with only minimum withdrawals and tax associated over their lifetimes. For inherited IRAs created before January 1, 2020, those beneficiaries will be able to continue to stretch the IRA and withdraw over their lifetimes.

Surviving spouses and certain special situations such as those beneficiaries who are disabled or chronically ill can still stretch the IRA required minimum distributions (RMDs) out over their lifetimes. Surviving spouses will continue to be able to roll their deceased spouse’s retirement account into their own.

Required Minimum Distributions (RMDs) starting age changed from 70 ½ to 72:

The new law has extended the age for starting required minimum distributions from your IRA. Those already age 70 ½ and taking RMDs will continue. For those who have not started RMDs and turn age 70 ½ in 2020 or later, you will not be required to start taking them until age 72 now. This is good news for those who want to delay withdrawals as long as possible to avoid recognizing income and paying the taxes associated.

IRA Contributions Allowed at Any Age Now:

In the past, once you reached age 70 ½, you could no longer contribute to an IRA even if you were still working. With the new law, the age limit has been removed. You can now contribute to both traditional IRAs and Roth IRAs at any age as long as you have earned income.

New Parents Can Now Make Penalty Free Withdrawals:

Within a year of birth or child adoption, new parents can now take penalty-free distributions up to $5,000 to cover related expenses from an IRA or other retirement plan. Income taxes will still be owed on these distributions but the 10% penalty on early withdrawals will be avoided.

Utilizing 529 Plans for Student Loan Payments:

You can now withdraw up to $10,000 from 529 savings plans to make student loan payments. These withdrawals would be tax and penalty free.

My Thoughts:

It is clear that Congress recognizes that people are living and working longer with the extension of the start date for RMDs and also cancelling the age requirement to make IRA contributions. The elimination of the stretch IRA does bring changes to estate planning. In the past, a commonly used technique was to leave your assets in trust for your children with IRAs still having the stretch provision ability. Now with the withdrawal limit being 10 years, some documents will need to be reviewed and updated. The expectation is that there will be more explanation how this new law affects trusts in the coming months.

Not only does this Secure Act affect retirement and estate planning, but also tax planning. Under the new 10-year rule, the funds in an inherited IRA can be withdrawn at any time as long as they are depleted at the end of 10 years. This opens the door for tax planning such as allowing withdrawals to be taken equally over 10 years, all in one particular year if the beneficiary has lower taxable income or postponing the entire withdrawal until year 10.

For perspective, under the old laws where children who inherited an IRA from a parent were able to stretch the IRA withdrawals over their own lifetime, a 50-year old person who received an inherited IRA from a parent would be required to take an initial withdrawal of approximately 3% of the retirement account the year following their parent's death. That withdrawal rate would increase slightly each year and rise to approximately 4% by age 60 and 7% by age 70. The stretch IRA allowed more tax deferral for those who did not need more withdrawals than the minimum required from inherited IRAs. The new 10-year rule speeds up the required withdrawals which could cause an increase in taxes for beneficiaries.

So, what are the takeaways or action items:

- Review your IRA/401(k) beneficiaries and estate planning documents

- Consider IRA or Roth IRA contributions if you are over age 70 ½ and still working

- Consider a Roth Conversion on a portion of your IRA assets to have more control over the tax associated

If you would like to discuss or learn more, schedule a call or meeting with me using the link below:

Tripp Yates, CPA/PFS, CFP®

901.413.8659 tripp@eaglestrong.com

Tripp’s passion for financial planning is evident to each and every client he meets with. His desire is to help his clients organize their finances, reduce taxes, and invest wisely. As a fee-only fiduciary advisor, Tripp strives to work in a humble and transparent way.

With extensive experience in financial planning and investment management, Tripp diligently uses his credentials of CPA and CFP® to benefit his clients. Over the last ten years, he has managed over $100 million in assets for individuals and families. In 2017, he founded Eaglestrong Financial, specializing in helping dentists and business owners. Outside of work, Tripp enjoys running, spending time with his family, and cheering on his favorite sports teams. He is an active member of Harvest Church.

References

https://www.kitces.com/blog/secure-act-2019-stretch-ira-rmd-effective-date-mep-auto-enrollment/

https://www.irahelp.com/printable/2019-single-life-expectancy-table-0

Disclaimer

Eaglestrong Financial, LLC is a Registered Investment Advisor offering advisory services in the states of TN and MS and in other jurisdictions where exempted. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Past performance is no guarantee of future results.

#eaglestrong #eaglestrongfinancial

Share with others: