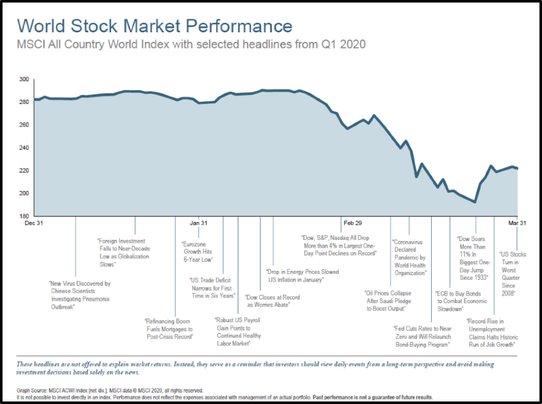

The 1st quarter of 2020 brought on a pandemic health crisis, shutdowns in economic activity, and swift stock market declines. The uncertainty surrounding the impact and length of COVID-19 continues to affect our way of life. Shelter in place orders have been issued across the country closing most businesses until the threat of the virus spread subsides. Unemployment claims skyrocketed as expected.

The US and global stock markets fell into bear market territory (greater than 20% decline) quicker than we have ever seen. Stock market declines were seen across the board through the end of the quarter 1: (-21%) US, (-31%) US small companies, (-23%) International Developed, and (-24%) Emerging Markets. The US total bond market was positive (+3%).

At first glance, we compared COVID-19 to viruses and outbreaks of the recent past. It is clear now that this one is much different. I don’t believe anyone alive today could recall a time period over their lives like the one we are living right now. Today is certainly different for our way of life and health, the economy, and the financial markets. But, event shocks to our country and financial system have always been new and different when they occur. Whether war, terrorist attacks, or the credit crisis that led to the Great Recession in 2008, we endured.

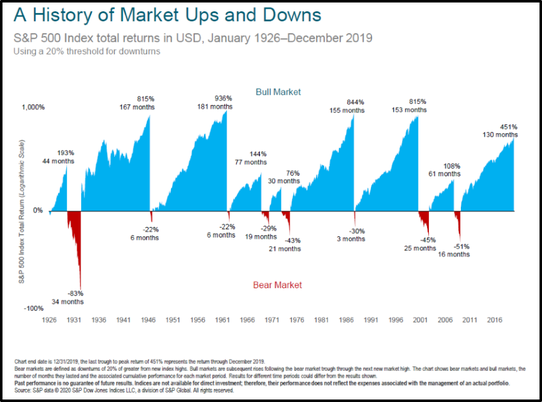

During the current market downturn, it is important to look at history as a guide. The future in financial markets does not always go exactly according to the past, but there is usually rhythm. Well-known investor Sir John Templeton said it best “The four most dangerous words in investing are: ‘This time it’s different.’ ”

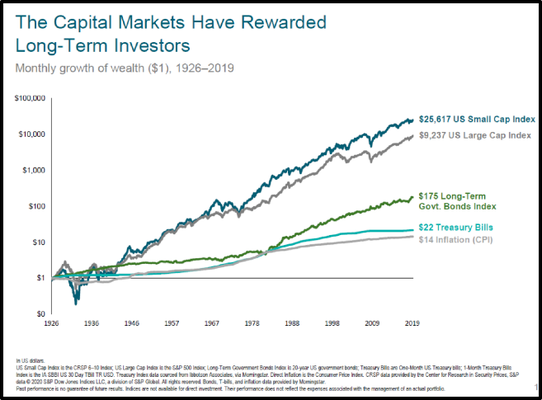

Bull (20% advance from market bottom) and bear (20% decline from market top) markets have been a part of our investing history. While bear market declines bring frustration and anxiety, they have always been overshadowed by the eventual advance in size and length of bull markets. This very reason is what drives long-term investment returns.

Uncertainty in the short-term has led to higher long-term investment returns. That is why stocks have outperformed bonds and cash over history. Investors are ultimately paid for taking risk and staying the course through market downturns. Allocations to bonds and cash allow more stability during times of decline such as what we are experiencing now. That is why asset allocation to achieve your goals is so important.

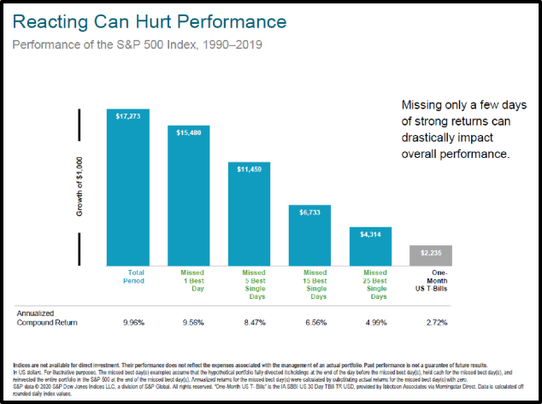

The biggest question right now is when will this end? When will the pandemic subside? When will the economy and the markets recover? No one knows for sure, but most likely the financial markets will start recovering before all is clear. The markets are forward looking. In the last week of March, we saw a 15% rebound in the US (S&P 500) and World (MSCI World) stock markets 2. No one expected this. We could most certainly see further declines but this is why staying the course with your investments is so important so that you capture the market returns when they occur. Over the last 30 years, if you just missed the best 25 days in the US stock market, your annualized investment return would have been cut in half (5% instead of 10%). $1,000 would be worth $4,314 instead of $17,273 if you had stayed invested.

Usually, big market down days are followed by big market up days. We saw that many times in the month of March. Right now, worst case scenarios are the main topic in the news. What happens if a drug is approved or vaccine developed to stop the virus? The common thought is that this will take time but we do not know for sure. It is evident that all medical researchers and pharmaceutical companies are working tirelessly to come up with a solution. We should know in the coming weeks if the shelter in place measures have had a positive effect on slowing the spread.

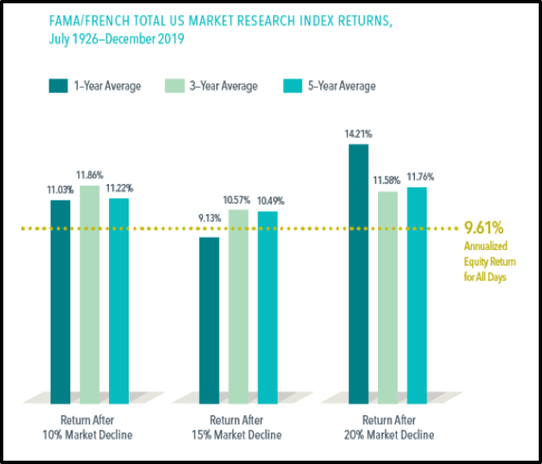

US stock market returns have produced average annual returns of 9.6% over history. Following declines of 20% or more (bear market) like we have just experienced, annualized returns have been higher 1 year (+14.2%), 3 years (+11.6%), and 5 years (+11.8%) later.

Famous investor Warren Buffet once said, “The stock market is a device for transferring money from the impatient to the patient.” While we cannot know for sure how long the current downturn will last, it will pass. Investing and sticking with a diversified portfolio will continue to drive long-term investment returns to achieve goals.

If you would like to discuss or learn more, schedule a call or meeting with me using the link below:

Tripp Yates, CPA/PFS, CFP®

901.413.8659 tripp@eaglestrong.com

Tripp’s passion for financial planning is evident to each and every client he meets with. His desire is to help his clients organize their finances, reduce taxes, and invest wisely. As a fee-only fiduciary advisor, Tripp strives to work in a humble and transparent way.

With extensive experience in financial planning and investment management, Tripp diligently uses his credentials of CPA and CFP® to benefit his clients. Over the last ten years, he has managed over $100 million in assets for individuals and families. In 2017, he founded Eaglestrong Financial, specializing in helping dentists and business owners. Outside of work, Tripp enjoys running, spending time with his family, and cheering on his favorite sports teams. He is an active member of Harvest Church.

References

1. 1st quarter 2020 stock market returns: US – Russell 3000 Index, US small companies – Russell 2000, International Developed – MSCI World ex US, Emerging Markets – MSCI Emerging Markets.

2. Total returns from 3/24/20 – 3/31/20: US S&P 500 (+15.6%), MSCI All Country World Index (+15.3%).

Disclaimer

Eaglestrong Financial, LLC is a Registered Investment Advisor offering advisory services in the states of TN and MS and in other jurisdictions where exempted. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Past performance is no guarantee of future results.

#eaglestrong #eaglestrongfinancial

Share with others: