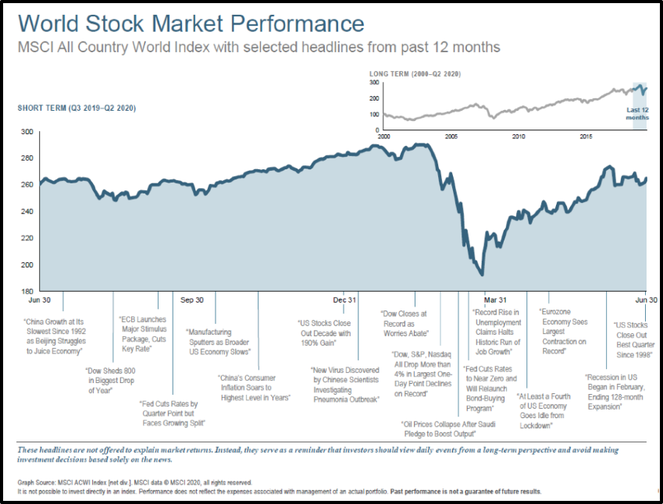

What a first half of 2020! This year has been a wild ride in so many ways. From forced business shutdowns and school closings in late March and April to mask mandates today, we have all been forced to adapt to a new normal under the ongoing threat of the Coronavirus. After seeing the fastest stock market decline in history from mid-February to late March, we have seen one of the quickest market rebounds through the end of June. For the 2nd quarter1, stocks recovered across the board: (+22%) US, (+25%) US small companies, (+15%) International Developed, and (+18%) Emerging Markets. The US total bond market was positive as well (+3%).

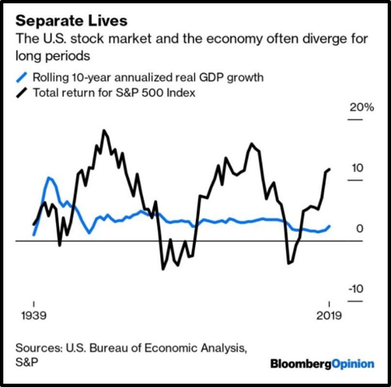

Many have raised the question – How is the market recovering when the economy is still down? It seems logical for the stock market to have not recovered, right? Businesses are not back completely, unemployment is still very high, sports are on hold, and many forms of entertainment outside our homes are non-existent at the moment. However, past history has given us evidence that even though it seems logical, the stock market is not the economy and doesn’t follow it in lockstep. For instance, in 1982 and 2009 even though unemployment was still rising, the US market (S&P 500) was forward-looking with gains of 20%+ in both years as the recession was ending.

1982

Unemployment began 1982 at 8.6% and ended the year at 10.8%.

The recession started in July 1981 and ended in November 1982.

The US market (S&P 500) gained 21.6% in 1982.

2009

Unemployment began 2009 at 7.7% and ended the year at 10%.

The recession started in December 2007 and ended in June 2009.

The US market (S&P 500) gained 26.5% in 2009.

The stock market is constantly forward-looking. When talk of the impact of the virus and possible shutdowns circulated in late February and early March, the market selloff began. At that point, companies had not lost any revenue but the expectations for the coming months were dire. The worst was feared and implied. One month later in April, even during government shutdowns of businesses, the virus impact was not as bad as feared in the initial projections. In the meantime, the government passed a massive stimulus plan and dramatically lowered interest rates. This combination made the prospects of the near future much better than expected.

Now, here we are today amid a cloud of uncertainty with what the rest of 2020 will look like. Another shutdown would most likely lower expectations, earnings, and the stock market. A drug development for vaccine or treatment of the virus would obviously raise short-term expectations. My point is this, in the short-term, surprises of information (good and bad) drive the market on a daily and weekly basis. In the long-term, future earnings and interest rates power the market. Jerome Powell, the Federal Reserve chairman, has indicated that interest rates are going to be low for the foreseeable future. Company earnings will depend on what level businesses are able to function in the days ahead. We will defeat the virus but how long it takes us to do so will be key over the next 6-18 months.

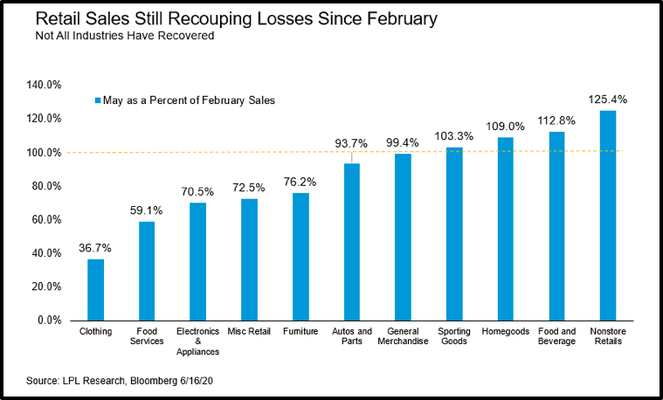

Some industries have weathered the virus storm much better than others. Technological advances have allowed many businesses to continue to operate at full capacity. Online or non-store retail showed 125% of sales in May vs. February while in-store clothing, electronics and furniture were still down. This is no surprise given the current conditions.

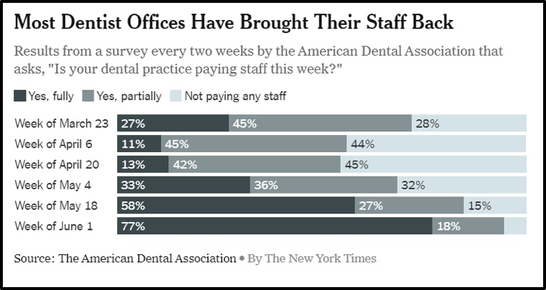

A recent New York Times article highlighted the importance of watching dentist offices as a barometer on how the economy is recovering. There are no substitutes for the work that dentists do and most treatment requires in-office visits. According to the American Dental Association survey, 77% of dentists had full staff back the first week of June and 18% were partially staffed. It is assumed that most dentist offices received stimulus funds from the government’s Paycheck Protection Program. Therefore, it will be key to see this staffing trend continue in the coming months as those stimulus funds are used up.

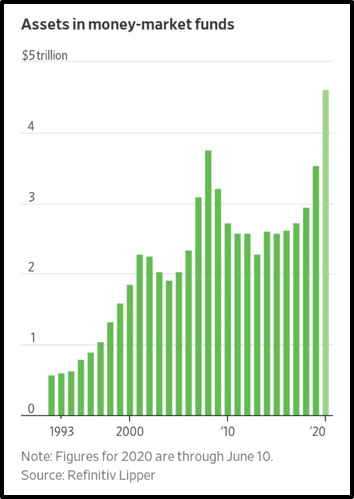

Due to continued economic uncertainty caused by the virus, the level of cash in money market funds is at an all-time high near $5 trillion. With interest rates near zero, those with cash will ultimately be forced to spend or invest the money. Many believe this is only further indication that can and will drive the market higher in the future as opportunities and confidence evolve.

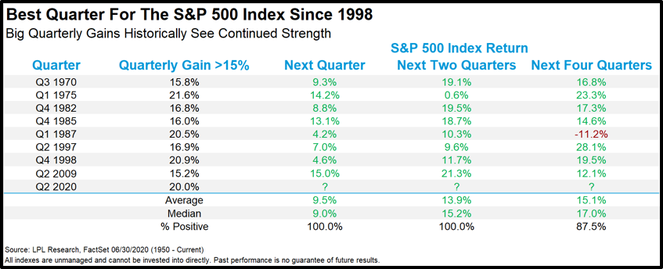

We often look at history to provide a guide for the future. Even still, there are no guarantees in investing, especially in the short-term. However, it is interesting that since 1950 whenever we had a quarterly gain in the US stock market (S&P 500) of 15% or more like we just experienced, the following quarter has been positive every time with an average of +9.5%. We cannot know the impact of the virus over the next 6 months and that will most likely be the biggest factor, but historical evidence is fascinating nonetheless.

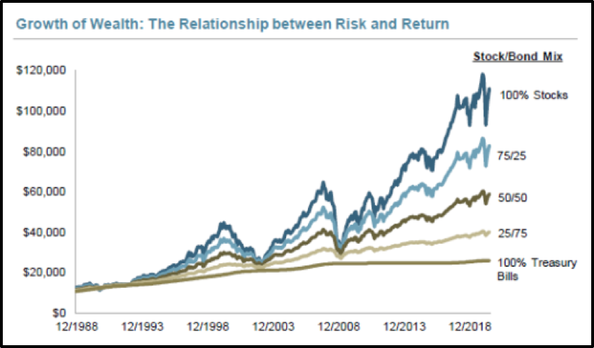

As we enter the third quarter of 2020, many questions remain unanswered. What will school and business look like this fall? How will the elections turn out? Those questions will be answered at the appropriate time. The truth is there have always been and always will be many questions. We cannot know the future no matter how comfortable and confident we feel at a given moment. What we do know is that investing over the long-term with the appropriate asset allocation to achieve goals has and will continue to reward investors.

If you would like to discuss or learn more, schedule a call or meeting with me using the link below:

Tripp Yates, CPA/PFS, CFP®

901.413.8659 tripp@eaglestrong.com

Tripp’s passion for financial planning is evident to each and every client he meets with. His desire is to help his clients organize their finances, reduce taxes, and invest wisely. As a fee-only fiduciary advisor, Tripp strives to work in a humble and transparent way.

With extensive experience in financial planning and investment management, Tripp diligently uses his credentials of CPA and CFP® to benefit his clients. Over the last ten years, he has managed over $100 million in assets for individuals and families. In 2017, he founded Eaglestrong Financial, specializing in helping dentists and business owners. Outside of work, Tripp enjoys running, spending time with his family, and cheering on his favorite sports teams. He is an active member of Harvest Church.

References

- 2nd quarter 2020 stock market returns: US – Russell 3000 Index, US small companies – Russell 2000, International Developed – MSCI World ex US, Emerging Markets – MSCI Emerging Markets.

https://www.morningstar.com/articles/982525/the-stock-market-is-not-the-economy

https://www.federalreservehistory.org/essays/great_recession_of_200709

https://www.nytimes.com/2020/05/10/business/stock-market-economy-coronavirus.html

Disclaimer

Eaglestrong Financial, LLC is a Registered Investment Advisor offering advisory services in the states of TN and MS and in other jurisdictions where exempted. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Past performance is no guarantee of future results.

#eaglestrong #eaglestrongfinancial

Share with others: