The global pandemic has brought on many changes in 2020. One of those changes, historically low interest rates, has created an opportunity for current and aspiring homeowners.

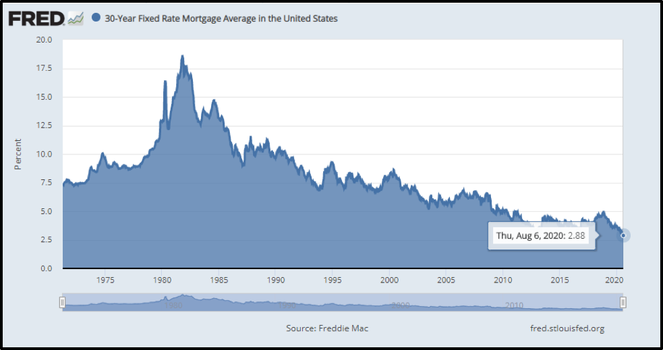

The average 30-year fixed mortgage rate is 2.88% currently. This is the lowest rate on the chart below going back to 1971. Keep in mind that 2.88% is the average rate. Therefore, some people are getting rates lower than the average. I’ve heard of someone getting as low as 2.5%.

The highest 30-year fixed rate was 18.63% in October 1981. I was born in 1981, so interest rates have been coming down most of my lifetime. Looking back over the last decade, the rate was 4.49% 10 years ago, 3.91% 5 years ago, 3.89% 3 years ago, and 3.60% this time last year.

To understand the impact of the current rate, let’s look at the difference for a $300,000 30-year mortgage.

- At 4%, the monthly principal and interest payment would be $1,432. The total interest paid over the life of the loan would be $215,609.

- At 2.5%, the monthly principal and interest payment would be $1,185. The total interest paid over the life of the loan would be $126,731.

- The savings on your payments from a 4% loan to a 2.5% loan would be $247 per month and $88,878 in interest over 30 years. That is substantial!

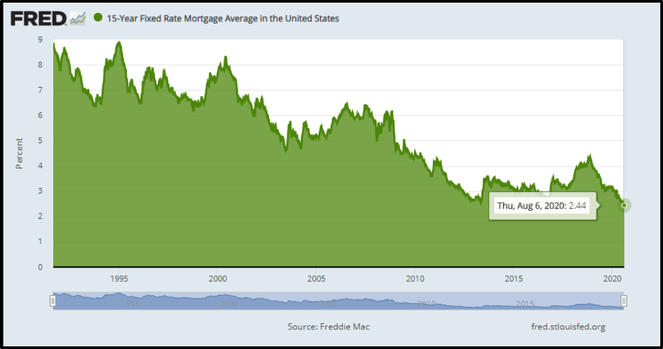

The average 15-year fixed mortgage rate is 2.44% currently. This is the lowest rate on the chart below going back to 1991. I have seen someone report getting a rate as low as 2.25%.

The highest 15-year fixed rate in the chart was close to 9% at the end of 1994. The average rate was 3.18% 3 years ago and 3.05% this time last year.

What if you chose a 15-year fixed rate mortgage for $300,000 instead of a 30-year?

- At 2.25%, the monthly principal and interest payment would be $1,965. The total interest paid over the life of the loan would be $53,746.

- The monthly payment would increase by $780 per month vs. a 2.5% 30-year fixed rate loan. This increase is significant. However, the overall interest paid over the term of the loan would be $53,746 which is $72,985 less vs. the 30-year.

The bottom line is that we are seeing all-time lows in interest rates. Therefore, it would be wise to look at your current mortgage to determine if you should refinance to lower your interest rate and/or years to payoff. Because closing costs related to refinancing your mortgage can range from 3-6%, it most likely would not make sense for someone planning to sell their home or payoff the associated mortgage in the next 5 years. Additionally, the difference in your current rate vs. the refinance rate needs to be close to 1% to make it worthwhile.

Strategically minimizing interest and maximizing cash flow will bode well for your financial plan now and for years to come.

If you would like to discuss or learn more, schedule a call or meeting with me using the link below:

Tripp Yates, CPA/PFS, CFP®

901.413.8659 tripp@eaglestrong.com

Tripp’s passion for financial planning is evident to each and every client he meets with. His desire is to help his clients organize their finances, reduce taxes, and invest wisely. As a fee-only fiduciary advisor, Tripp strives to work in a humble and transparent way.

With extensive experience in financial planning and investment management, Tripp diligently uses his credentials of CPA and CFP® to benefit his clients. Over the last ten years, he has managed over $100 million in assets for individuals and families. In 2017, he founded Eaglestrong Financial, specializing in helping dentists and business owners. Outside of work, Tripp enjoys running, spending time with his family, and cheering on his favorite sports teams. He is an active member of Harvest Church.

References

https://www.bankrate.com/calculators/mortgages/amortization-calculator.aspx

Disclaimer

Eaglestrong Financial, LLC is a Registered Investment Advisor offering advisory services in the states of TN and MS and in other jurisdictions where exempted. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Past performance is no guarantee of future results.

#eaglestrong #eaglestrongfinancial

Share with others: