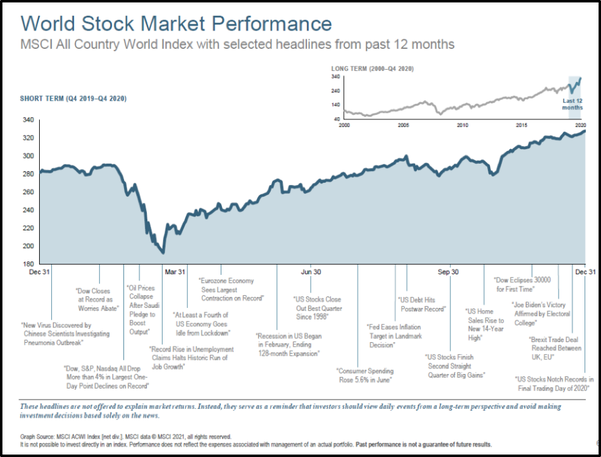

Despite continued uncertainty with the pandemic and a historic presidential election, the overall stock market capped a remarkable year with a strong finish. The illustration below highlights the V-shaped recovery in the stock market and puts the year into perspective. We recognize we are still fighting COVID-19, but it feels there is a light at the end of the tunnel with vaccine distribution in progress.

For the 4th quarter1, stocks advanced across the board: (+15%) US, (+33%) US small companies, (+16%) International Developed, and (+20%) Emerging Markets. The US total bond market was slightly positive as well (+0.7%).

While most everyone is looking forward to 2021, 2020 will be quite a year for the history books. The overall US stock market at its low this year on March 23rd was down just over 30%. Since then, it rallied through the end of the year to finish +20% for 20201. Many have questioned this market advance while the pandemic continues to hamper businesses and our way of life. Government intervention has been massive and it is clear it had an effect. All-time low interest rates, direct stimulus checks to Americans, Paycheck Protection Program (PPP) for businesses, and increased unemployment insurance are just a few of the mechanisms deployed by our government. Some businesses have thrived during the pandemic due to technological advances while others such as restaurants and entertainment have been hit hard by forced shutdowns. With the vaccine distribution starting and accelerating in 2021, there are three catalysts that we see that imply increased growth in the New Year.

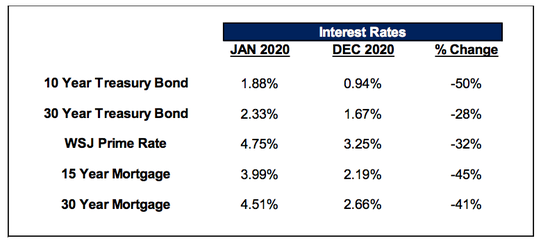

1) Low interest rates for the foreseeable future

Interest rates started 2020 at low levels, historically. Most people did not expect or predict rates to go lower. However, the unforeseen pandemic that shut down and altered the economy led to our government slashing rates to spur economic growth. That is where we are today. The Federal Reserve (FED) Chairman Jerome Powell has indicated a desire to keep interest rates low for the foreseeable future which could mean 12-24 months depending on the economic trajectory. Low interest rates have already caused a boom in mortgage refinancing. Businesses will also be able to borrow money at low rates to start-up or expand. This will continue to encourage investment.

The flip side of low interest rates is that those with money in cash, CDs and bonds will endure a period hard to find much interest income. Nevertheless, these conservative asset classes serve their purpose of holding up during times of stock market downturns like what we experienced last March.

2) Government stimulus

The US government has authorized approximately $3.5 trillion this year in legislative spending to intervene in the economic downturn caused by the pandemic. For comparison, Congress spent $1.8 trillion in stimulus during the Great Recession of 2008. 2020 stimulus has included the initial direct payments to Americans (below certain income thresholds) and the 2nd round of $600 per person that was recently passed. For businesses, the Paycheck Protection Program (PPP) was needed to counter forced government shutdowns. A new round of PPP is just starting for those businesses that can show a 25% reduction in revenue from any quarter in 2020 vs. the same quarter in 2019 or the full year in revenue. These are just a few highlights of the government stimulus. Some politicians have indicated there is more stimulus to come. In the near-term, all these stimulus measures are likely to have a positive effect on the economy and risk assets such as stocks.

3) Pent-up demand

We have heard story after story of people holding off taking vacations or trips until the pandemic is over. Even those who have traveled during the pandemic have traveled less than usual. In the same way, many people are staying at home a lot more which has decreased their spending on gas for their vehicles and eating out at restaurants. While our way of life has been altered, people will be ready to go and do when the pandemic is over. This may be the biggest driver of growth when it comes. We could see this in the summer or fall depending on the success of vaccinations. While not the same, the period after World War II is a good example of pent up demand.

From the book “The Psychology of Money” by Morgan Housel:

“Then the 1950s came around and we suddenly realized, “Wow, we have some amazing new inventions. And we’re really good at making them. Appliances, cars, phones, air conditioning, electricity. It was nearly impossible to buy many household goods during the war, because factories were converted to make guns and ships. That created pent-up demand from GIs for stuff after the war ended. Married, eager to get on with life, and emboldened with new cheap consumer credit, they went on a buying spree like the country had never seen.”

Make no mistake, the pandemic is not World War II. But there are some similaries of economic shutdowns. Innovation has not stopped during the pandemic much like it did not stop during World War II. We believe we will see new efficiences on the other side of the pandemic. Pent-up demand will likely lead to higher prices and inflation but that is what the government (FED) wants for a healthier economy.

While we have a positive outlook, that does not mean there will not be setbacks along the way. We could experience an unforeseen event or the vaccine distribution could take longer than expected. Our political landscape is polarized with a transition of power ahead. Democrats are taking control of the White House, keeping control of the House of Representatives, and have a slight one vote advantage in the Senate. While one party will have a majority for the next two years, it will be very thin in the Senate so it will be interesting to see if more stimulus is passed like expected and if Democrats are able to raise taxes. Regardless of politics, we believe the catalysts we have outlined will prevail in further growth.

We are encouraged as we start 2021. We hope you are too!

If you would like to discuss or learn more, schedule a call or meeting with me using the link below:

Tripp Yates, CPA/PFS, CFP®

901.413.8659 tripp@eaglestrong.com

Tripp’s passion for financial planning is evident to each and every client he meets with. His desire is to help his clients organize their finances, reduce taxes, and invest wisely. As a fee-only fiduciary advisor, Tripp strives to work in a humble and transparent way.

With extensive experience in financial planning and investment management, Tripp diligently uses his credentials of CPA and CFP® to benefit his clients. Over the last ten years, he has managed over $100 million in assets for individuals and families. In 2017, he founded Eaglestrong Financial, specializing in helping dentists and business owners. Outside of work, Tripp enjoys running, spending time with his family, and cheering on his favorite sports teams. He is an active member of Harvest Church.

References

1 4th quarter 2020 and year-to-date stock market returns: US – Russell 3000 Index, US small companies – Russell 2000, International Developed – MSCI World ex US, Emerging Markets – MSCI Emerging Markets, Large growth stocks – Russell 1000 Growth Index.

https://www.bankrate.com/rates/interest-rates/prime-rate.aspx

Disclaimer

Eaglestrong Financial, LLC is a Registered Investment Advisor offering advisory services in the states of TN and MS and in other jurisdictions where exempted. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Past performance is no guarantee of future results.

#eaglestrong #eaglestrongfinancial

Share with others: