President Biden released a proposed “American Families Plan” on April 28th. This proposal increased government benefits through expanded government-funded education, child credits, and unemployment insurance as well as investments in infrastructure. It made headline news because a large part of the plan cost is to be paid by various tax law changes. To be clear, this is still just a proposal and will have to pass both the U.S. House and Senate to become law. There are likely to be changes and tweaks in the days ahead, but we would expect a vote to surface in the coming months. The Democrats have a 9-vote majority in the House while they hold the tie breaking vote in the Senate with the one vote of the Vice President. Therefore, Democrats could pass this proposed legislation, but more than likely there will be changes to satisfy more moderate Democrats that hold all the power in the very narrow majority.

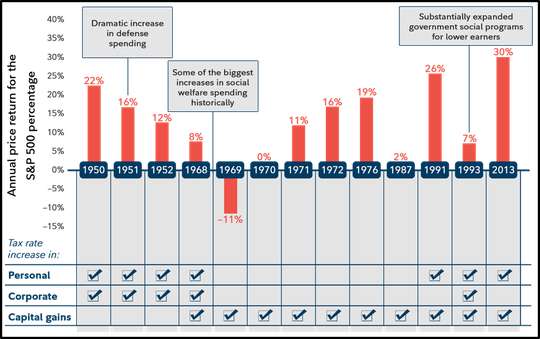

So, what does the possibly of higher tax rates mean for you? Will the increase in tax rates cause investors to sell highly appreciated assets (stocks, businesses, real estate) to try to lock in a lower tax rate before rates increase? Will higher corporate taxes lower profits and cause a reduction in earnings? Will the stock market fall because of these effects on individuals and corporations? These are all valid questions. However, history has shown us that tax increases don’t necessarily lead to a stock market selloff. As shown in the chart below (since 1950), only in 1969 did the US stock market (S&P 500) experience a negative return (-11%) in the year of a tax increase.

While tax laws have changed over history, there have been only two other times since 1950 where changes were made to personal income, corporate, and capital gains tax rates all at the same time. There has already been characterization that this is a “moonshot” proposal as a starting point that will be negotiated. Look for changes to surface, but we will outline the key points in the Biden proposal.

Personal Income Tax

- President Biden continues to say that he is only looking to raise taxes on those with income of more than $400,000. It is not clear if that means for single filers or married couples.

Conventional wisdom is that $400,000 would be for married couples and a lesser income amount would be for single filers.

- The proposal would raise the top income tax bracket from 37% to 39.6%. Today, married couples do not reach the highest tax rate of 37% until their taxable income is above $628,300. Single filers reach the highest rate at taxable income over $523,600.

Businesses

- In 2018, corporate tax rates decreased from 35% to 21% as part of President Trump’s 2017 Tax Cut and Jobs Act. President Biden has proposed an increase to 28% but has also indicated he would

be open to negotiation of a 25% rate.

- While President Biden has proposed higher tax rates for corporations, it appears that the 20% Qualified Business Income Deduction for pass-through businesses (Sole Proprietor, LLC, S-Corp) will remain in place for now. This is good news for small businesses.

Capital Gains & Dividends

- Capital gains and qualified dividend rates would be increased from 20% to ordinary income rates of 39.6% for households with more than $1 million in income. Combined with the net investment

income tax already in place of 3.8%, the combined tax rate would increase from 23.8% to 43.4%.

- Currently, the 15% tax rate on capital gains and qualified dividends applies to married filers with income below $501,600 and single filers with incomes below $445,850. The 20% rate would

apply to those with higher incomes below $1 million. This should not change.

- “Like kind” exchanges on the sale of real estate would be eliminated for gains greater than $500,000.

- For gains in excess of $1 million, the “step-up in basis” on property inherited at death would be eliminated. This change could affect many people in the future as family members inherit long held security positions with large gains, family-owned businesses or farms. These large gains would become taxable at death instead of passing to family members without incurring capital gains tax. There has been discussion of including protections for family-owned businesses as well as the ability to pay the tax associated with illiquid assets over 15 years. It is possible this part of the proposal will be changed or taken out all together as it sounds like it is unpopular with many members of Congress.

Estate Tax

- Currently, individuals can pass $11.7 million of their assets without estate tax to their heirs. This means a married couple could pass $23.4 million estate tax free.

- Even though the estate tax was not mentioned in the Biden proposal, there has been speculation that the individual level could decrease to $5 million or $3.5 million as part of changes in the negotiation.

While most of the tax changes target those with income above $400,000 and even more so for those with income above $1 million, the elimination of the “step up in basis” could affect a wider range of people. It has been mentioned that the change in capital gain rates for income earners over $1 million will be retroactive to April 28th when the plan was introduced. While that could happen, it is not likely to pass both the House and the Senate. More than likely, the new tax laws will be passed later this year and go into effect on January 1, 2022. If you are looking to sell highly appreciated property such as a business or real estate either this year or next, you may want to consider the tax implications of liquidating in 2021 at a lower tax rate assuming the legislation is not retroactive. We will monitor the changes as they come about and as always help you plan accordingly.

Keep in mind that our economy and stock market have endured many tax law changes over history. We recognize the importance of optimizing tax minimization and efficiency in building wealth. We also believe specific strategic planning can have a substantial impact in certain cases. Often, it is small proactive decisions each year that seem to be immaterial but turn out to be significant over a 10-, 15- or 20-year period.

The last time we experienced increases in our personal income and capital gain tax rates was 2013. The chart below shows that if you invested $100,000 on January 1, 2013 in the U.S. stock market (S&P 500) it would have more than tripled in valued to $357,077 at the end of June. While the idea of paying more taxes out of pocket is most likely not enjoyable for anyone, history has shown that investing for the long-term endures.

As always, please be encouraged to reach out should you have any questions. It is my pleasure to serve you!

Tripp Yates, CPA/PFS, CFP®

901.413.8659 tripp@eaglestrong.com

Tripp’s passion for financial planning is evident to each and every client he meets with. His desire is to help his clients organize their finances, reduce taxes, and invest wisely. As a fee-only fiduciary advisor, Tripp strives to work in a humble and transparent way.

With extensive experience in financial planning and investment management, Tripp diligently uses his credentials of CPA and CFP® to benefit his clients. Over the last ten years, he has managed over $100 million in assets for individuals and families. In 2017, he founded Eaglestrong Financial, specializing in helping dentists and business owners. Outside of work, Tripp enjoys running, spending time with his family, and cheering on his favorite sports teams. He is an active member of Harvest Church.

References

https://www.fidelity.com/learning-center/trading-investing/tax-hikes-history

https://www.natlawreview.com/article/how-might-joe-biden-s-tax-proposals-affect-you

https://pressgallery.house.gov/member-data/party-breakdown

Disclaimer

Eaglestrong Financial, LLC is a Registered Investment Advisor offering advisory services in the states of TN and MS and in other jurisdictions where exempted. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Past performance is no guarantee of future results.

#eaglestrong #eaglestrongfinancial

Share with others: