We are now approaching two years since the start of the pandemic in the United States. The recent virus surge with the Omicron variant spread very quickly, but the severity overall has been milder than previous variants. This past week the Spanish Prime Minister proposed that the European Union start treating COVID as an endemic like the seasonal flu instead of a pandemic. The number of cases has recently dropped in the UK after reaching a peak. Scientists at the University of Washington are predicting the same drop-off in cases in the United States later this month. Some believe this may be the turning point to where COVID is much more manageable going forward.

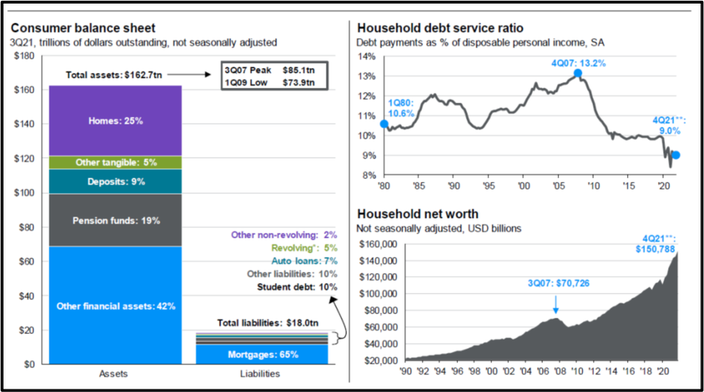

The stock market and the economy have both seen V-shaped recoveries. The focus now turns to interest rates and inflation while U.S. consumer balance sheets are strong. The chart below shows that consumer assets totaled $162.7 trillion at the end of the third quarter in 2021. That compares to $85.1 trillion at the peak in 2007 before the great recession and financial crisis. Because of COVID and government shutdowns, interest rates plummeted in 2020 from already low levels historically. This allowed most homeowners to lock in low long-term rates either through purchasing a new house or refinancing their existing mortgage. According to Len Kiefer, Deputy Chief Economist at Freddie Mac, there were over 8 million refinances in 2020 and 6 million in 2021. Each refinance borrower saved about $2,800 a year in lower mortgage payments. This freed up about $40 billion in cash flow for U.S. homeowners over the past 2 years. Household net worth today is higher than it has ever been. What does all this mean? U.S. consumer finances are in good shape. That should bode well for spending and investment in the near future.

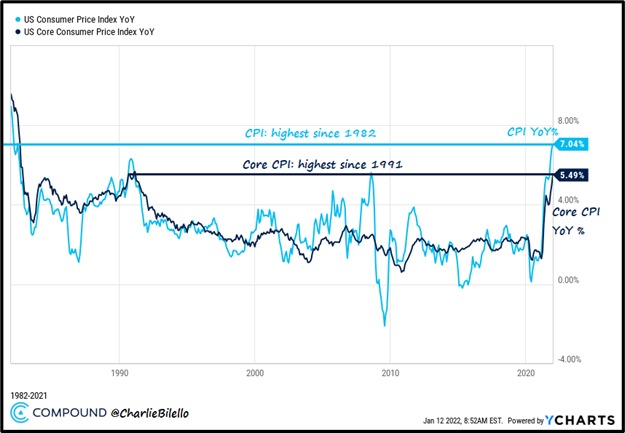

Low inventory, supply-chain disruptions, and employee shortages combined with strong consumer balance sheets is a perfect recipe for inflation. The recent consumer price index (CPI) showed inflation at 7% over the last year. This is the highest reading since 1982. Core CPI which excludes food and energy is up 5.5% over the last year. While we don’t want to see this high inflation over an extended period of time, some inflation is positive for the economy. Peter Lazaroff put together thoughts on the positive side of inflation recently. From homeowners benefiting with increasing home values to higher wages for workers, there are some good things that come with inflation.

With most government stimulus measures ending in 2021, we should see hiring continue to accelerate in 2022. The inventory and supply chain situation will take time to normalize, but if we can move from a pandemic to an endemic in the near future, we should start to see some improvements.

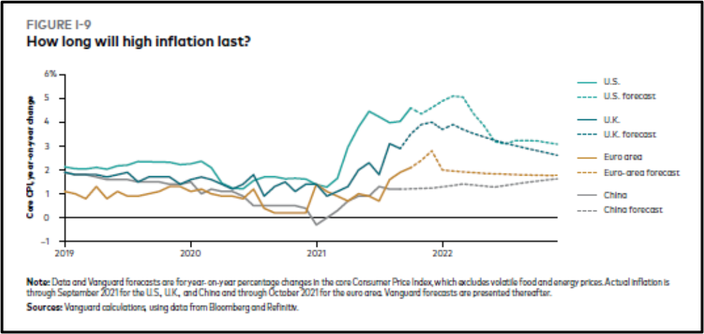

How long will this current high inflation last? In the Vanguard forecast below, the expectation is to see inflation fall and level off around the long-term average of 3% sometime later this year. Current core inflation of 5.5% is already slightly higher than the projections shown in the chart below. Forecasts are what they are – guesses or predictions.

To combat inflation, the U.S. Federal Reserve is expected to raise interest rates several times this year starting in March. With an improving economy, the average 30-year fixed mortgage rate has climbed from 3.1% at the end of 2021 to 3.45% today. The 10-year treasury bond yield has risen from 1.5% at the end of 2021 to 1.8% today with anticipation of Federal Reserve action.

Because the start of rising interest rates generally occurs around an improving economy, the U.S. stock market (S&P 500) has mostly moved higher along with the start of rising interest rates to a certain point. Going back to 2009 (post financial crisis) the divergence of stocks and rising interest rates began once the 10-year treasury reached 3.6%. Before that, from 1965 to 2009 (pre financial crisis), rising interest rates and stock market returns were positively correlated until the 10-year yield reached 4.5%. The future can be different from the past, but with the current yield at 1.8% today, we still have a ways to go to get to 3.6% or 4.5%.

We have gone through a period recently of large U.S. growth stocks outperforming most other areas of the stock market. International stocks have underperformed U.S. stocks for the last decade. These trends could continue, but history has shown us that they don’t last forever. We are likely to see some changes in 2022 as we move further in the economic cycle.

The U.S. Census Bureau reported that 5.4 million new business applications were filed in 2021 vs. 4.4 million in 2020. Both of these numbers are much higher than 3.5 million filed in 2019 (pre-COVID). Entrepreneurship is still on the rise which is a positive sign.

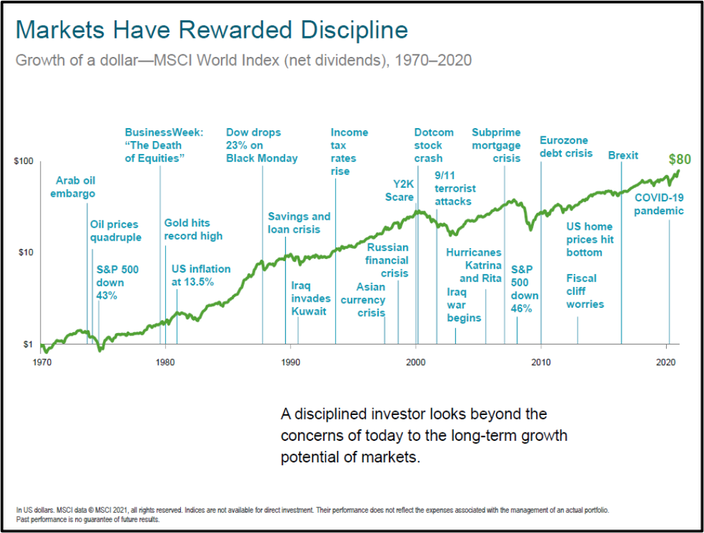

The two biggest known factors that will affect the stock market in 2022 will be the Fed getting the degree and timing of interest rate hikes correct as well as earnings growth of companies. As always, unknown events can have a short-term effect on markets as well. We continue to believe that diversification is the foundation of a good long-term investment strategy in all market environments.

In December David Booth, the founder of Dimensional Fund Advisors, wrote a perspective “Why I’ll Always Be Optimistic About the Market.” We agree with David and have highlighted a few of his quotes below.

“Markets represent people coming together: We can’t predict the nature and timing of a crisis, but we can bank on human ingenuity finding a path through it. Markets are forward-looking and reflect this optimism – an optimism that I believe is innate to humanity. And your optimism only increases when you begin to understand how markets work.”

“In 2022, new challenges await. New businesses will grow. Old ones will adapt. Some will fail, while others flourish. Rather than having to guess what will happen to whom and when, I choose a different path. I invest in the market. It is a unique human invention. From it flows our modern life.”

If you would like to discuss or learn more, schedule a call or meeting with me using the link below:

Tripp Yates, CPA/PFS, CFP®

901.413.8659 tripp@eaglestrong.com

Tripp’s passion for financial planning is evident to each and every client he meets with. His desire is to help his clients organize their finances, reduce taxes, and invest wisely. As a fee-only fiduciary advisor, Tripp strives to work in a humble and transparent way.

With extensive experience in financial planning and investment management, Tripp diligently uses his credentials of CPA and CFP® to benefit his clients. Over the last ten years, he has managed over $100 million in assets for individuals and families. In 2017, he founded Eaglestrong Financial, specializing in helping dentists and business owners. Outside of work, Tripp enjoys running, spending time with his family, and cheering on his favorite sports teams. He is an active member of Harvest Church.

References

https://typeshare.co/peterlazaroff/posts/why-im-not-worried-about-inflation

https://www.reuters.com/business/feds-daly-us-interest-rate-hikes-could-start-march-2022-01-12/

https://finance.yahoo.com/quote/%5ETNX/history?p=%5ETNX

https://www.dimensional.com/us-en/insights/why-ill-always-be-optimistic-about-the-market

FactSet, J.P. Morgan Asset Management, X-intercept for each data set is calculated using a quadratic regression where interest rates are the independent variable and the rolling 2-year correlation of stock returns and interest rate movements is the dependent variable. Guide to the Markets – U.S. Data are as of December 31, 2021.

Disclaimer

Eaglestrong Financial, LLC is a Registered Investment Advisor offering advisory services in the states of TN and MS and in other jurisdictions where exempted. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Past performance is no guarantee of future results.

#eaglestrong #eaglestrongfinancial

Share with others: