In aviation terms, a headwind is wind pushing against the front of the aircraft which slows it down. A tailwind is wind pushing the tail of the aircraft and helping it go faster. In business terms, headwinds are situations or conditions that make growth harder, while tailwinds are situations or conditions that increase growth, revenues, or profits.

Currently in the economy, there are competing forces at play. Our goal is to explain the conditions that are trying to hinder growth and the conditions that are trying to accelerate growth so that you can more clearly understand the volatility we are experiencing. It is also why we do not think it is wise to try to predict the future (which no one can do), but it is wise to prepare for the volatility and be very clear on your goals and expectations.

Headlines & Headwinds

High inflation, rising interest rates and the war in Ukraine dominated the headlines for the first quarter of 2022. While the unemployment rate has fallen back to levels close to pre-pandemic (3.6% vs. 3.5% February 2020), there is a widespread labor shortage affecting most businesses and industries. There are whispers of shortages in areas of food supply on the horizon due to a convergence of the headlines noted. While some inflation and rise in interest rates is positive economically, it is the degree to which both have risen in a short period of time that is unusual.

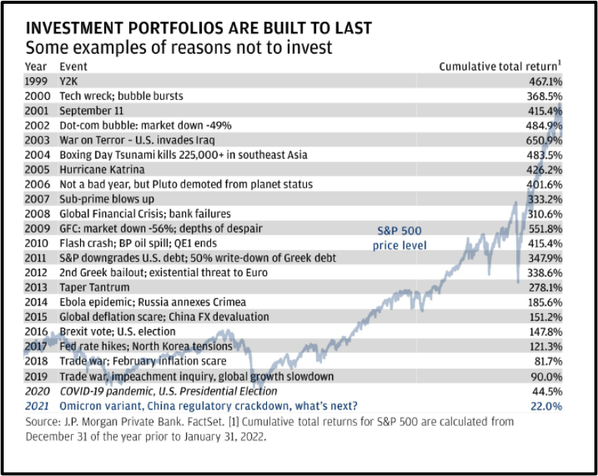

The expectation is that interest rates will continue to rise throughout 2022 to combat inflation. The Federal Reserve is trying to balance addressing inflation with raising interest rates while also avoiding a recession in the economy. The war in Ukraine further complicates their work as Russia is a major supplier of energy and fertilizers to the world economy. While the US and other countries will continue to find ways to adjust without supplies from Russia, it will take time to see the impact on our economy outside of rising gasoline prices. Interestingly, the US stock market has recovered from the correction that ensued with the initial news of Russia invading Ukraine in February. At the moment, the focus has shifted back to inflation and interest rates. We are farther along in the economic cycle and the narrative has changed from recovery to companies sustaining growth and profitability amid headwinds. The headlines bring on anxiety which is normal but keep in mind the stock market must constantly climb a wall of worry over the long-term. What appears to be an imminent threat today could be a forgotten blip on the screen in the coming months. The chart below highlights many of the reasons not to invest since 1999 and the corresponding cumulative total return of the U.S. stock market (S&P 500).

The simultaneous pullback in both the stock and bond market this past quarter is different from the normal relationship where bonds produce stability when stocks are down. Bonds will still serve their role in portfolios in providing diversification during stock market downturns but it was inevitable that we would go through a period of rising interest rates considering the historical lows over the last two years. While rising interest rates are a current headwind for bondholders, they will ultimately be welcomed for those seeking a higher yield. The yield on cash has been practically 0% for the last several years and the yield on total bonds has been around 2%. Historically, yields for cash have been 2-3% and bonds 4-5%. The diversification benefits of bonds will be more apparent once interest rates settle closer to more historical levels.

Facts

The current level of inflation 7.9% is the highest reading since the early 1980s. Similarly, wages have increased 5.6% over the last year which is higher than the 2-3% in recent years. Wage increases are positive but not quite enough to offset inflation.

The interest rate on the 10-year treasury bond just crossed 2.5% this week vs. 1.5% at the beginning of the year. The U.S. Federal Reserve has only increased the Federal Funds rate by 0.25% in 2022. The expectation is that that they will raise rates at each of their remaining six meetings in 2022. The bond market is already pricing these rate hikes into the market even before they actually happen.

Mortgage rates have risen substantially over the last three months. The average 30-year fixed mortgage rate crossed 5% this week. The 30-year rate began 2022 around 3.1%. Meanwhile, the average price of a new home is up 25% over the last year. Many homeowners took advantage of historically low interest rates over the past two years. There were over 8 million refinances in 2020 and about 6 million in 2021. Each refinance borrower saved about $2,800 a year in lower payments.

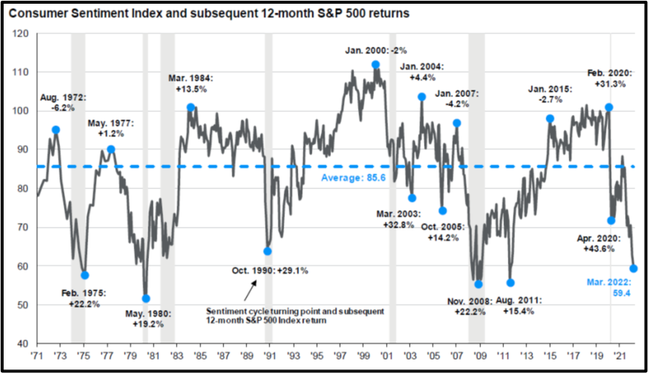

Consumer confidence is at the lowest level since 2011 (see chart below). While it is not clear if this is the current trough, on average over the past 50 years, buying into the U.S. stock market (S&P 500) at a confidence peak yielded an investment return of 4.4% in the following year vs. 24.5% when buying at a trough. Low consumer confidence could be a positive sign for the stock market as this implies expectations are low.

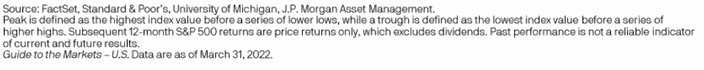

COVID-19 cases and fatalities across the U.S. have plummeted. Hotel occupancy, seated diners in restaurants, and TSA traveler traffic at airports are getting really close to full recovery in activity compared to 2019 before the pandemic (see chart below). This is positive news for the economy as we approach summer vacation season.

Tailwinds

Despite the current headwinds, there are some possible tailwinds to the current economic environment.

- Consumers and corporations combined are holding around $19 trillion in cash which is up 35% from 2019 according to Bank of America economists. This could be a positive sign for spending and investment amid inflation and rising interest rates.

- There are currently 10.9 million open jobs which equates to 1.7 openings per unemployed person. If economic growth slows due to the headwinds we have outlined, employees that are laid off should have new opportunities to work that would help other businesses fill labor shortages. Further, the low unemployment rate could remain intact.

- Business investment orders (non-defense capital goods excluding aircraft) reached a record high of $80.1 billion in January. This includes heavy machinery and expensive equipment that allows businesses to work more efficiently to meet consumer demands. Keep in mind these are orders that may not have shipped yet but businesses have determined they are needed to meet current and future demand. This is not a sign of imminent recession.

While the start of 2022 has been challenging for investors, keep in mind one quarter is a very short period of time over a long-term investment horizon. Headwinds make good headlines, but don’t ignore the competing tailwinds. We must keep a long-term perspective because the issues of today can change very quickly. We continue to remain focused on diversification, asset allocation and tax efficiency to meet client goals. Stay the course.

If you would like to discuss or learn more, schedule a call or meeting with me using the link below:

Tripp Yates, CPA/PFS, CFP®

901.413.8659 tripp@eaglestrong.com

Tripp’s passion for financial planning is evident to each and every client he meets with. His desire is to help his clients organize their finances, reduce taxes, and invest wisely. As a fee-only fiduciary advisor, Tripp strives to work in a humble and transparent way.

With extensive experience in financial planning and investment management, Tripp diligently uses his credentials of CPA and CFP® to benefit his clients. Over the last ten years, he has managed over $100 million in assets for individuals and families. In 2017, he founded Eaglestrong Financial, specializing in helping dentists and business owners. Outside of work, Tripp enjoys running, spending time with his family, and cheering on his favorite sports teams. He is an active member of Harvest Church.

References

J.P. Morgan Asset Management Guide to the Markets 2Q 2022 – U.S. Data are as of March 31, 2022.

https://ustr.gov/countries-regions/europe-middle-east/russia-and-eurasia/russia

https://www.bls.gov/news.release/pdf/empsit.pdf

https://www.nytimes.com/2022/04/01/business/economy/jobs-fed-wages.html

https://www.cnbc.com/2022/04/05/us-bonds-treasury-yields-rise-and-remain-inverted.html

https://fred.stlouisfed.org/series/MORTGAGE30US

@ChicagoAdvisor

@lenkiefer

https://www.tker.co/p/saving-job-openings-capex-orders?s=r

Disclaimer

Eaglestrong Financial, LLC is a Registered Investment Advisor offering advisory services in the states of TN and MS and in other jurisdictions where exempted. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Past performance is no guarantee of future results.

#eaglestrong #eaglestrongfinancial

Share with others: