The first half of 2022 has been a challenge for both stocks and bonds alike. The stock market is not the economy and tends to be forward looking or months ahead of the actual economy. It usually falls before the economy contracts and in the same way it usually starts rebounding before the economy starts expanding again. That is why it is impossible to time the market. A surprise of good or bad news can swing the market in a short period of time.

With inflation readings higher than we have seen in the last 40 years, the U.S. Federal Reserve started raising interest rates in March. As we moved to the 2nd quarter, inflation still remained high which adjusted expectations for the Fed to have to act more aggressively than was anticipated. Expectation of higher interest rates lowered bond values and also caused repricing in stock values. The logical thought is higher interest rates eventually slow the economy which reduce corporate profits. Higher interest rates also reduce current bond values because new bonds pay higher interest.

What lies ahead for the 2nd half of 2022? Will higher interest rates slow the economy enough to cause a recession? Will we start seeing inflation fall signaling that the Fed’s strategy is working? My guess is that what will happen is probably not the worst or best expected outcome but somewhere in between.

In his book “The Psychology of Money,” Morgan Housel tells us that market downturns are the price of admission to ultimately achieving long-term investment returns.

“Like everything else worthwhile, successful investing demands a price. But its currency is not dollars and cents. It’s volatility, fear, doubt, uncertainty, and regret – all of which are easy to overlook until you’re dealing with them in real time.”

If we can accept market volatility as the price of admission to successful investing, then we can expect downturns periodically. That does not mean we like them but recognize they are part of the process. Based on the history of the U.S. stock market we should expect a selloff of:

-5% Three times a year

-10% Once a year

-20% Every few years

-50% A few times in our lives

It is clear that the biggest problem our economy faces right now is 40-year high inflation. Admitting that no one can predict the future, here are some thoughts on the current environment.

- U.S. stock market valuations are looking more attractive after crossing into a bear market (20% decline from previous high) sell-off the first half of this year. As of June 30th, the forward price to earnings ratio on the S&P 500 (U.S. market) is 15.94 vs. the 25-year average of 16.85. Price has fallen but earnings have held up so far. Some earnings contraction in the 2nd half of this year is to be expected.

- Mid-Term election years are historically challenging in the stock market with an average drawdown of 17% since 1931. 2022 fits this narrative with mid-term elections coming up in November.

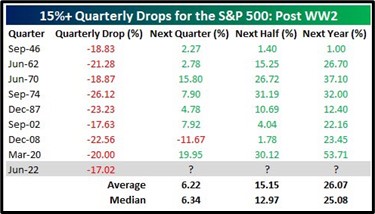

- There have been nine quarterly drops of 15%+ or more in the S&P 500 since 1946 including our most recent quarter. All previous periods except December 2008 posted positive returns in the following quarter. (via bespokeinvest - @carlquintanilla)

- There are already some signs of falling prices in commodities which may indicate reduced inflation. Corn, wheat, and soybeans are all down over 25% from their highs and below where they were before Russia invaded Ukraine. (via @charliebilello) If we start to see falling inflation this could indicate that the U.S. Fed may be able to halt raising interest rates to slow the economy.

- If we are experiencing an economic recession, it is a unique one. The employment picture is still strong with 5.5 million more open positions than unemployed people. The unemployment rate was 3.6% in May vs. 14.7% at the height of the pandemic in April 2020 and a 50-year average of 6.2%.

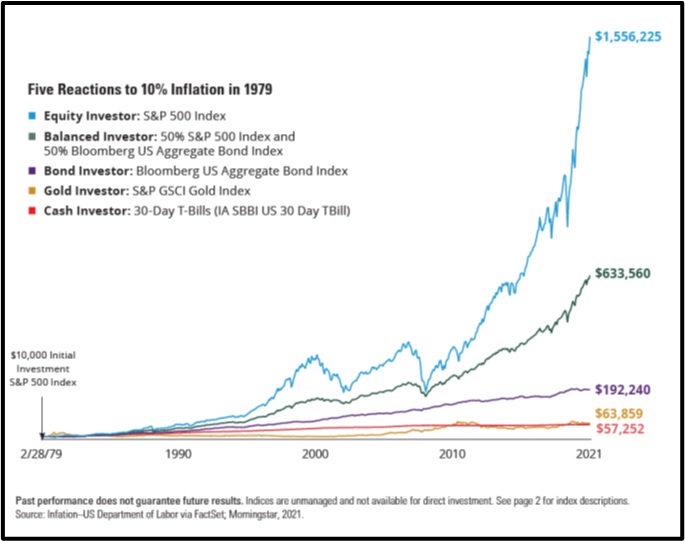

- The last time inflation was 10% was in February of 1979. Investor anxiety was high as it is today. What many thought as “safer” choices such as bonds, gold, and cash provided temporary relief but substantially trailed equity and balanced investors over the long-term.

Expect more surprises in the 2nd half of 2022. With consumer sentiment at an all-time low a small amount of positive news would be welcomed. The current market environment is not an anomaly, it is expected. Every downturn is different given the circumstances, but nonetheless a part of the cycle to achieve positive long-term investment returns. Stay the course.

If you would like to discuss or learn more, schedule a call or meeting with me using the link below:

Tripp Yates, CPA/PFS, CFP®

901.413.8659 tripp@eaglestrong.com

Tripp’s passion for financial planning is evident to each and every client he meets with. His desire is to help his clients organize their finances, reduce taxes, and invest wisely. As a fee-only fiduciary advisor, Tripp strives to work in a humble and transparent way.

With extensive experience in financial planning and investment management, Tripp diligently uses his credentials of CPA and CFP® to benefit his clients. Over the last ten years, he has managed over $100 million in assets for individuals and families. In 2017, he founded Eaglestrong Financial, specializing in helping dentists and business owners. Outside of work, Tripp enjoys running, spending time with his family, and cheering on his favorite sports teams. He is an active member of Harvest Church.

References

J.P. Morgan Asset Management Guide to the Markets 3Q 2022 – U.S. Data are as of June 30, 2022.

https://twitter.com/SethCL/status/1543583841692041221

https://twitter.com/jaykaeppel/status/1542655238011756547

https://twitter.com/charliebilello/status/1544518115681255424

https://twitter.com/BullandBaird/status/1542181932817063937

Disclaimer

Eaglestrong Financial, LLC is a Registered Investment Advisor offering advisory services in the states of TN and MS and in other jurisdictions where exempted. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Past performance is no guarantee of future results.

#eaglestrong #eaglestrongfinancial

Share with others: