Heightened volatility in the stock and bond markets has been ongoing throughout 2022. It became further amplified in the 3rd quarter with new market lows in the stock market and interest rates rising to levels we haven’t seen in quite a while. The US stock market (S&P 500) rallied for 2 months off an initial low of -23% in mid-June to -9% in mid-August. The idea was that inflation was going to come down and the U.S. Federal Reserve was not going to have to raise interest rates as much as initially thought. Then, in mid-August that idea began to change as more economic data was released. A new inflation report released in September showed that while year over year inflation receded from 8.5% in July to 8.3% in August, mostly attributable to lower energy costs, other areas such as food, shelter and medical services rose. Additionally, month over month inflation barely increased instead of expectations of declining. This caused the Federal Reserve to change their tune to more tough talk on raising interest rates and keeping them higher for longer. Interest rate expectations changed dramatically, and another stock market sell-off ensued producing a new low in the U.S. stock market (S&P 500) of -24% on the year through the end of September.

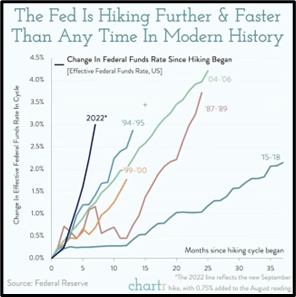

The rise in interest rates in such a short period of time is unprecedented. Rising interest rates have led to a reduction in bond values with the U.S. Aggregate Bond Index -15% in 2022. This may be the biggest story of 2022 as diversified investors expect bonds to preserve in a stock market downturn.

The 10-year treasury bond yield registered 3.8% at the end of the quarter, up from 1.5% at the beginning of the year. Higher yields are a positive development for bond investors going forward as yields have been extremely low over the last decade. Additionally, some money market funds and cash in online banks are now earning over 2%.

The bottom line is that inflation must come down from the current 8% level. The Fed has repeatedly stated that their mandate is price stability (controlling inflation) over all else. At some point in the future, we will get reports of inflation retreating, such as from 8% to 7% or 6%. This will be positive news that the interest rate increases are working. It is expected the economy will slow down in the process. How much it will slow or have to slow to bring down inflation is the big question. The ultimate goal is 2% inflation but that will most likely take some time to achieve. The markets are looking for a “Fed Pivot” once its interest rate policy shows signs of working by inducing lower inflation. This could come in the form of monthly inflation data releases and/or comments from members of the Federal Reserve. Markets are forward looking so it is likely that they will react positively at hints and indications well before the inflation goal is reached. Much like today the market sell-off and interest rate increases are more influenced by expectations of the next 6-18 months.

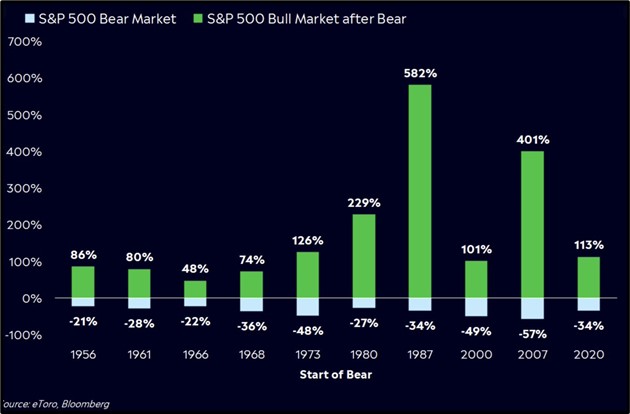

In times of market turbulence, risk is obvious and apparent. It’s important to zoom out and stay focused on the big picture. Over the last 10 years, the U.S. stock market has still produced 11%+ returns per year on average or 200%+ cumulative despite various downturns such as the current one. This is in line with historical expectations around 10% per year of stock market returns. We must endure the risk or downturns in order to achieve the reward. I often refer to history in speaking about the market. While our economy changes and evolves and every downturn has different catalysts, the driver of long-term stock market returns remains. Human ingenuity that increases company earnings is repeated over and over. Increases in company earnings leads to higher stock values. By owning a diversified portfolio with many companies, we get to participate in this growth. This is called market risk because we are willing to take on risk of periodic downturns in order to get the reward of expected higher rates of return.

To contrast, business risk or specific company risk is much different than market risk. Business owners and executives know they have to stay focused on the future so that their business grows, adapts and evolves. Changes in government regulations, technology, competition, etc. can all have direct effects on specific businesses. We have clearly seen this in 2022 as many stocks that were darlings during COVID have been pummeled year-to-date through September because we are no longer in lockdown. These companies, to name just a few below, could not maintain the high level of earnings and growth trajectory they achieved during COVID which caused overly optimistic expectations.

- Peloton -81%

- Roku -75%

- Netflix -61%

Looking back to 2008, business risk is evident as many banks have yet to return to their all-time highs achieved before the financial crisis. While the U.S. stock market recovered and advanced, many banks were altered from that point forward as their earnings had to be adjusted since their loan practices were more highly regulated.

Business risk can work positively as well in the cases of companies such as Amazon and Apple. However, hindsight is 20/20 and we usually only see the positive result by looking back. These companies have experienced much higher volatility and sharper downturns over the last 20 years that ultimately led to their ascendance as some of the most highly valued companies today. For every Amazon and Apple, there are hundreds of companies that don’t recover from extreme downturns such as Blockbuster and Enron.

As we enter the 4th quarter, eyes will continue to be heavily focused on inflation and interest rates. Additionally, the impact on slowing the economy, mid-term elections, and company earnings reports will factor in. There is no shortage of headline news. Based on previous US Fed interest rate hiking cycles, the Fed will most likely not stop raising interest rates until the Fed Funds Rate surpasses inflation. Today, the Fed Funds Rate is 3.25% and inflation (consumer price index) is 8.3%. However, the forward-looking stock market would be expected to act favorably before this happens if data and/or statements from the Federal Reserve start to trend in this direction. Bond values would also benefit if/when we get a “Fed Pivot” at any point in the future. Just this week, the market rallied on news of a decrease in job openings signaling a slower economy and that we are possibly closer to a “Fed Pivot” regarding interest rates. Following mid-term elections in November, more certainty will be provided surrounding the direction of government policies over the next 2 years. Over history, the more clarity provided after mid-term elections has tended to be a boost for stock prices. While we can’t predict the market bottom, keep in mind that bull markets (+20% or more) are made from bear markets (-20% or more). Stay the course. This too shall pass!

If you would like to discuss or learn more, schedule a call or meeting with me using the link below:

Tripp Yates, CPA/PFS, CFP®

901.413.8659 tripp@eaglestrong.com

Tripp’s passion for financial planning is evident to each and every client he meets with. His desire is to help his clients organize their finances, reduce taxes, and invest wisely. As a fee-only fiduciary advisor, Tripp strives to work in a humble and transparent way.

With extensive experience in financial planning and investment management, Tripp diligently uses his credentials of CPA and CFP® to benefit his clients. Over the last ten years, he has managed over $100 million in assets for individuals and families. In 2017, he founded Eaglestrong Financial, specializing in helping dentists and business owners. Outside of work, Tripp enjoys running, spending time with his family, and cheering on his favorite sports teams. He is an active member of Harvest Church.

References

3rd quarter 2022 stock and bond market returns: US – Russell 3000 Index, US small companies – Russell 2000, International Developed – MSCI World ex US, Emerging Markets – MSCI Emerging Markets, US total bond market – Barclays US Aggregate Bond Index

Investment returns obtained from Kwanti Portfolio Analytics. S&P 500 TR 1/1/2022 to 6/16/2022 = (22.5%). S&P 500 TR 6/17/2022 to 8/16/2022 = +17.68%. S&P 500 TR 1/1/2022 to 8/16/2022 = (8.8%). S&P 500 TR 8/17/2022 to 9/30/2022 = (16.52%). S&P 500 TR 1/1/2022 to 9/30/2022 = (23.87%) Barclays US Aggregate Bond Index 1/1/2022 to 9/30/2022 = (14.61%). PTON 1/1/2022 to 9/30/2022 = (80.62%). ROKU 1/1/2022 to 9/30/200 = (75.28%). NFLX 1/1/2022 to 9/30/2022 = (60.92%). S&P 500 TR 10/1/2012 to 9/30/2022 = +11.7% annualized.

https://www.investing.com/rates-bonds/u.s.-10-year-bond-yield-historical-data

https://twitter.com/RyanDetrick/status/1572653535959060480?s=20&t=Sx4UxIR07-nSxVcHoDnEGg

https://twitter.com/SethCL/status/1575817054225326081?s=20&t=Sx4UxIR07-nSxVcHoDnEGg

Disclaimer

Eaglestrong Financial, LLC is a Registered Investment Advisor offering advisory services in the states of TN and MS and in other jurisdictions where exempted. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Past performance is no guarantee of future results.

#eaglestrong #eaglestrongfinancial

Share with others: