2022 was a disappointing year for stock and bond investors alike. Higher inflation that we haven’t seen in decades, the war between Russia and Ukraine, and rising interest rates all had effects on asset prices. Because headline news mainly focuses on the negative, I thought it would be helpful to share actual headlines along with the silver lining or encouraging facts associated.

Headline: Stocks fall to end Wall Street’s worst year since 2008, S&P 500 finishes 2022 down nearly 20% - NBC News

Silver Lining: The S&P 500 (US Stock Market) did finish 2022 down 18% in what is the worst calendar year total return since 2008 when it was down 37%. However, it was positive 7%+ for the final three months of 2022.

Stocks of household names such as Amazon and Tesla were down 50% and 65%, respectively.

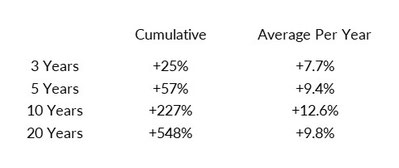

As long-term diversified stock investors, taking a look back at the US Stock Market (S&P 500) is more encouraging. Remember, there were countless negative news headlines throughout the last 20 years, but the stock market climbed the wall of worry as it has done repeatedly over history.

As US stock values fell in 2022, their value became more attractive for future investment. The price to earnings (PE) ratio of the S&P 500 was 21.4 at the beginning of 2022 and ended the year at 16.7 which is more in line with the average of 16.8 over the last 25 years.

Headline: The bond market turned in its worst performance ever this year – CNBC

Silver Lining: The Bloomberg U.S. Aggregate Bond Index finished the year down 13% after falling as much as 17% at one point in the year. This negative calendar year return in the overall bond index was unprecedented but directly linked to the rapid rise of interest rates in 2022 to combat inflation. The yield or interest rate on the U.S. bond index was 1.75% starting 2022 and finished the year at 4.68%. This higher yield is very positive for bond investors going forward and is more in line with historical bond yields. The rapid rise in interest rates was much like ripping a band aid off vs. slowly pulling at it.

Higher interest rates are not only positive for bond investors going forward, but also allow those with cash balances in the bank to start earning interest on savings of 3% or higher depending on the bank.

Turning the Page

Looking ahead to 2023, the big question remains whether or not the U.S. economy will enter a recession. It is possible we are already in it as official economic data is backward looking. I don’t put much weight into economic or market forecasts. They are simply guesses based on known facts. For example, let’s look at three well-known banks’ predictions for the S&P 500 in 2022 – Wells Fargo: 5,200; Goldman Sachs: 5,100; JP Morgan: 5,050. None of these forecasts were close. The S&P 500 ended the year at 3,840.

The biggest events in 2023 (good or bad) are most likely things we are not aware of today. Here are some thoughts as we start the new year.

- Inflation is coming down slowly. The year-over-year consumer price index (CPI) peak was 9% last June. In November, the year-over-year reading was 7.1%. While rising interest rates affected the stock and bond markets in 2022, it usually takes longer for them to affect housing, employment, and other parts of the economy that factor into the CPI reading.

- The expectation is that the U.S. Federal Reserve will continue to raise interest rates in 2023 but possibly reach a point where the inflation reading and slower economic growth give them confidence to halt their rate increases. This should be a positive development for stocks and bonds if it happens in 2023.

- An economic recession or slower growth in 2023 could mean layoffs for many workers. However, there has been a labor shortage across most industries since COVID shutdowns which would indicate that laid off employees should be able to find replacement jobs. 2023 could help to settle or stabilize employment as long as the incentive to work remains in place.

Don’t forget that the stock market is forward looking. While economic growth is likely to slow in 2023, if signs emerge that inflation is coming down to acceptable levels and expectations change for interest rate increases, the market will react before those expectations actually transpire. Much like in 2022, the stock market fell while parts of the economy are only starting to slow now.

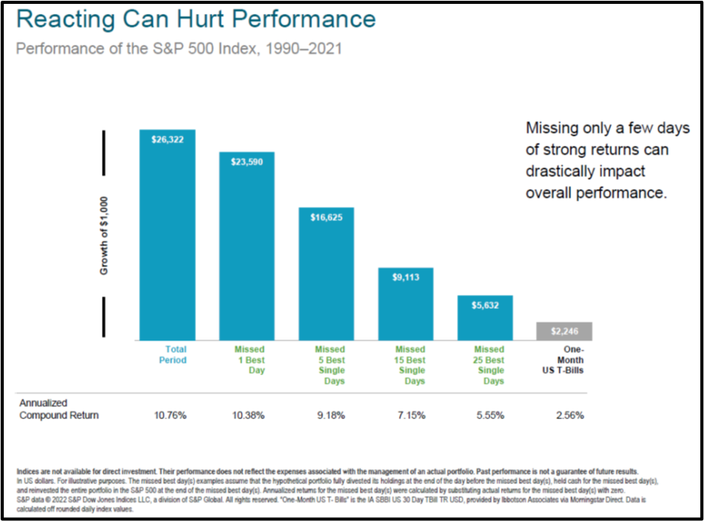

In periods of heightened uncertainty, it is human nature to want to try to avoid market downturns and only invest once things have settled down. The fallacy in that thought is there will not be a signal when the timing is right. We have to stay invested so that we don’t miss out on positive returns that ultimately meet our goals and expectations.

Famed investor Peter Lynch has a couple of iconic quotes that seem very timely for the year ahead.

- “Far more money has been lost by investors preparing for corrections or trying to anticipate them than has been lost in corrections themselves.”

- “Your ultimate success or failure will depend on your ability to ignore the worries of the world long enough to allow your investments to succeed.”

If you would like to discuss or learn more, schedule a call or meeting with me using the link below:

Tripp Yates, CPA/PFS, CFP®

901.413.8659 tripp@eaglestrong.com

Tripp’s passion for financial planning is evident to each and every client he meets with. His desire is to help his clients organize their finances, reduce taxes, and invest wisely. As a fee-only fiduciary advisor, Tripp strives to work in a humble and transparent way.

With extensive experience in financial planning and investment management, Tripp diligently uses his credentials of CPA and CFP® to benefit his clients. Over the last ten years, he has managed over $100 million in assets for individuals and families. In 2017, he founded Eaglestrong Financial, specializing in helping dentists and business owners. Outside of work, Tripp enjoys running, spending time with his family, and cheering on his favorite sports teams. He is an active member of Harvest Church.

References

4th quarter 2022 stock and bond market returns: US – Russell 3000 Index, US small companies – Russell 2000, International Developed – MSCI World ex US, Emerging Markets – MSCI Emerging Markets, US total bond market – Barclays US Aggregate Bond Index

Investment returns obtained from Kwanti Portfolio Analytics. S&P 500 TR 1/1/2022 to 12/31/2022 = (18.11%). S&P 500 TR 1/1/2008 to 12/31/2008 = (37%). S&P 500 TR 10/1/2022 to 12/31/2022 = +7.56%. S&P 500 TR 1/1/2020 to 12/31/2022 = +24.79% cumulative or +7.65% per year. S&P 500 TR 1/1/2018 to 12/31/2022 = +56.88% cumulative or +9.42% per year. S&P 500 TR 1/1/2013 to 12/31/2022 = +226.54% cumulative or +12.56% per year. S&P 500 TR 1/1/2003 to 12/31/2022 = +548.44% cumulative or +9.79% per year. Barclays US Aggregate Bond Index 1/1/2022 to 12/31/2022 = (13.01%). AMZN 1/1/2022 to 12/31/2022 = (49.62%). TSLA 1/1/2022 to 12/31/2022 = (65.03%).

https://www.cnbc.com/2022/12/26/the-bond-market-turned-in-its-worst-performance-ever-this-year.html

https://twitter.com/AlanJLSmith/status/1608757345076527104

https://twitter.com/StockMarketNerd/status/1596900251763630082

J.P. Morgan Asset Management Guide to the Markets 1Q 2023 – U.S. Data are as of December 31, 2022

Disclaimer

Eaglestrong Financial, LLC is a Registered Investment Advisor offering advisory services in the states of TN and MS and in other jurisdictions where exempted. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Past performance is no guarantee of future results.

#eaglestrong #eaglestrongfinancial

Share with others: