“Resilient” is what many have described the U.S. stock market in the 1st quarter of 2023. Despite continued rising interest rates and the failure of several banks, the U.S. stock market advanced 7.5% (S&P 500) and the bond market 3% (Barclays US Aggregate Bond Index). Federal Reserve members continue to comment that there are more interest rate hikes to come in order to bring inflation down. However, as each day passes, the effects of dramatic rate increases over the last year are slowing economic growth. In addition, the banking turmoil this past quarter will lead to much more stringent conditions for obtaining loans which also slows growth. The conundrum for the Fed of trying to tame inflation without sending the economy in a recession continues on. Employment has remained strong with the unemployment rate still low at 3.6% while the number of job openings has started to come down. The next scheduled meeting for the Fed regarding interest rates is in early May. At this point, the consensus is that they will either raise interest rates by another 0.25% or pause with no increases. A lot can happen and/or change in a month as more data is released.

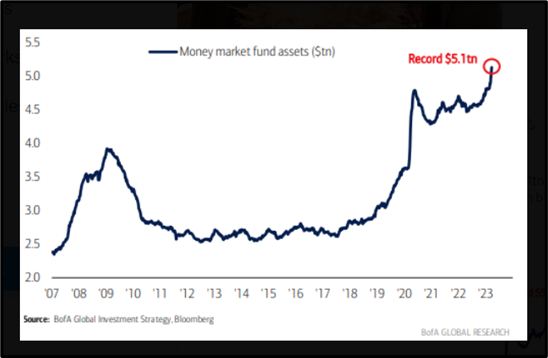

Cash is at an all-time high with money market fund assets of $5.1 trillion. This is greater than during the pandemic spike in 2020.

The consumer confidence index ended March at 62.0 which is still well below the average level of 85.6. What does this mean? Investor anxiety is evident. Pessimism may be extreme. It is also clear that the interest rate of 4%+ on many money market funds is enticing to investors. Lastly, it is promising that as interest rate increases halt and sentiment improves, this cash will ultimately be deployed as reinvestment in the market or spending in the economy.

In the words of words of famous investor Sir John Templeton “Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria."

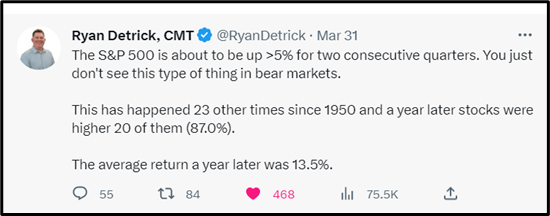

As pointed out in Ryan Detrick’s tweet above, the performance of the U.S. stock market (S&P 500) the last two quarters is unusual if we are still in a downturn. While the future can always be different than the past, I do find this interesting coupled with the pessimism I mentioned earlier.

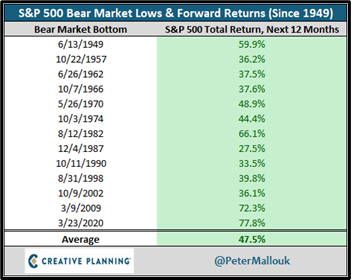

It is human nature to want to predict or anticipate short-term market movements based on the latest headlines. We have seen time and time again that sticking to your investment plan with a long-term focus is what allows you to achieve your goals and investment returns. As the chart from Peter Mallouk shows below, the market moves quickly once a bottom has been reached. It’s still questionable whether or not we experienced the bottom last October. Only time will tell. But we know the only way to capture return is to be invested. Stay the course!

If you would like to discuss or learn more, schedule a call or meeting with me using the link below:

Tripp Yates, CPA/PFS, CFP®

901.413.8659 tripp@eaglestrong.com

Tripp’s passion for financial planning is evident to each and every client he meets with. His desire is to help his clients organize their finances, reduce taxes, and invest wisely. As a fee-only fiduciary advisor, Tripp strives to work in a humble and transparent way.

With extensive experience in financial planning and investment management, Tripp diligently uses his credentials of CPA and CFP® to benefit his clients. Over the last ten years, he has managed over $100 million in assets for individuals and families. In 2017, he founded Eaglestrong Financial, specializing in helping dentists and business owners. Outside of work, Tripp enjoys running, spending time with his family, and cheering on his favorite sports teams. He is an active member of Harvest Church.

References

1st quarter 2023 stock and bond market returns: US – Russell 3000 Index, US small companies – Russell 2000, International Developed – MSCI World ex US, Emerging Markets – MSCI Emerging Markets, US total bond market – Barclays US Aggregate Bond Index

Investment returns obtained from Kwanti Portfolio Analytics. S&P 500 TR 1/1/2023 to 3/31/2023 = +7.5%. Barclays US Aggregate Bond Index 1/1/2023 to 3/31/2023 = +2.96%.

https://twitter.com/MarkNewtonCMT/status/1639346965749153792

https://twitter.com/RyanDetrick/status/1640132752354811906

https://twitter.com/SethCL/status/1640317942029008901

https://twitter.com/RyanDetrick/status/1641800032776011779

https://twitter.com/PeterMallouk/status/1626388459266134016

J.P. Morgan Asset Management Guide to the Markets 2Q 2023 – U.S. Data are as of March 31, 2023

Disclaimer

Eaglestrong Financial, LLC is a Registered Investment Advisor offering advisory services in the states of TN and MS and in other jurisdictions where exempted. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Past performance is no guarantee of future results.

#eaglestrong #eaglestrongfinancial

Share with others: