The U.S. stock market continued its march higher in the 2nd quarter to enter a new bull market reflected by an advance of 20% or more from the market low reached in October of last year. There is still much skepticism surrounding the near-term path of the stock market due to the uncertainty in the economy. While higher interest rates should continue to slow growth in the economy, inflation continues to recede while the employment picture is still very strong. The current situation brings back to mind John Templeton’s famous quote – “Bull-markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.”

The recent path forward has endured a couple of “crisis” situations in 2023. In early spring, Silicon Valley Bank and Signature Bank failed due to deposit outflows that they could not meet because of losses in their bond portfolios from rapid interest rate increases over the last year. The Federal Reserve stepped in to provide support for banks needing additional capital which stabilized the situation. Just recently, it was announced that the Fed also conducted a “stress test” on large banks showing that they were in good condition. In June, we endured the political back-and-forth surrounding the U.S. debt ceiling. Politicians came together and passed legislation to avoid a default. The worst-case scenarios that many people were counting on did not materialize.

For the first half of 2023, technology companies led the advance after being laggards in the downturn of 2022. The U.S. stock market (S&P 500) +16.9%, U.S. small companies (Russell 2000) +8.1%, International Developed (MSCI EAFE) +11.7%, Emerging Markets (MSCI Emerging Markets) +4.9%. Bonds appreciated as well in the first half of the year +2.1% (Barclays US Aggregate).

Over the last two years it has been very clear that market forecasters are simply guessing. That is why we continue to stress focusing on the long-term and ignoring short-term forecasts. In December of 2021, the median forecast for the U.S. stock market (S&P 500) for 2022 was a gain of 7.5%. The actual return was -18.1%. In December of 2022, 18 out of 20 Wall Street Strategists predicted the market would end 2023 below 4,300. As of June 30th, the index closed at 4,450. I realize we still have 6 months to go for 2023 but things are trending for another year of forecasting folly.

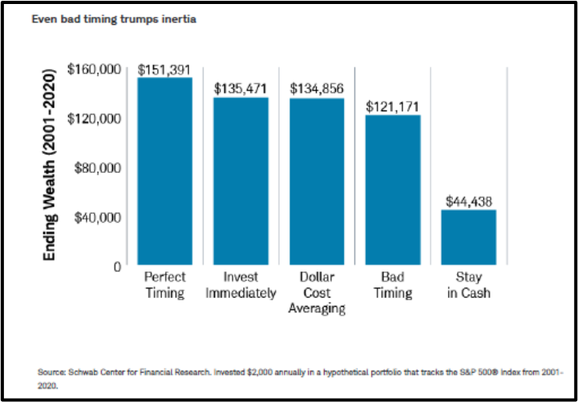

Periodically, questions are posed to me about if “now” is a good time to invest. Human nature affects all of us in trying to buy in at the perfect time. I give my thoughts but at the same time recognize my inability to know exactly what will happen in the near future. I lean on longer periods such as 3-, 5- and 10-year time frames based on the market cycles repeated history. Charles Schwab did research on market timing and the data is intriguing. Their conclusion was that “there’s a high cost to waiting for the best entry point”. They used five different long-term investor situations. Each investor received $2,000 at the beginning of every year for the 20 years ending in 2020 and invested the money in the U.S. stock market (S&P 500).

While the perfect timer faired the best as we would expect, the invest immediately and dollar cost averaging investor were not too far behind. Even the bad timer did pretty well. If we recognize that perfect timing is nearly impossible, we see that participating and investing is most important.

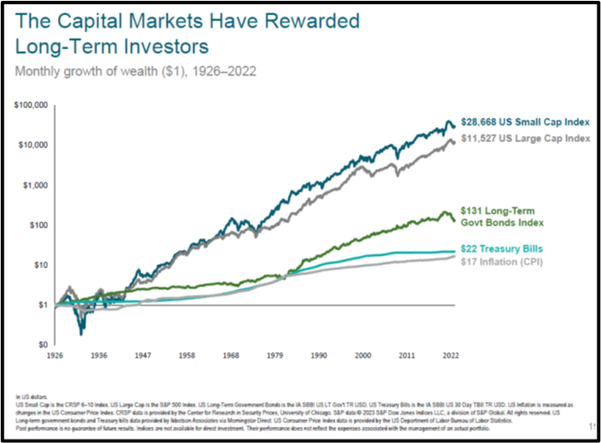

As we look to the 2nd half of 2023, know that we will endure more surprises good and bad. Inflation, interest rates, and employment will most likely continue to dominate the short-term direction of the market. As long-term investors, a promising future is in our favor. Stay the course!

If you would like to discuss or learn more, schedule a call or meeting with me using the link below:

Tripp Yates, CPA/PFS, CFP®

901.413.8659 tripp@eaglestrong.com

Tripp’s passion for financial planning is evident to each and every client he meets with. His desire is to help his clients organize their finances, reduce taxes, and invest wisely. As a fee-only fiduciary advisor, Tripp strives to work in a humble and transparent way.

With extensive experience in financial planning and investment management, Tripp diligently uses his credentials of CPA and CFP® to benefit his clients. Over the last ten years, he has managed over $100 million in assets for individuals and families. In 2017, he founded Eaglestrong Financial, specializing in helping dentists and business owners. Outside of work, Tripp enjoys running, spending time with his family, and cheering on his favorite sports teams. He is an active member of Harvest Church.

References

Investment returns obtained from Kwanti Portfolio Analytics. 1/1/2023 to 6/30/2023. S&P 500 TR = +16.9%. Russell 2000 Index TR = 8.1%. MSCI EAFE Index TR = 11.7%. MSCI Emerging Markets Index TR = 4.9%. Barclays US Aggregate Bond Index 1/1/2023 to 6/30/2023 = +2.1%.

https://www.reuters.com/markets/europe/wall-street-strategists-see-more-gains-2022-2021-12-01/

https://finance.yahoo.com/quote/%5EGSPC/history?p=%5EGSPC

https://www.schwab.com/learn/story/does-market-timing-work

Disclaimer

Eaglestrong Financial, LLC is a Registered Investment Advisor offering advisory services in the states of TN and MS and in other jurisdictions where exempted. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Past performance is no guarantee of future results.

#eaglestrong #eaglestrongfinancial

Share with others: