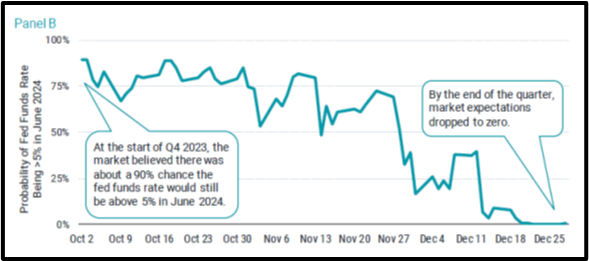

The U.S. stock market finished 2023 strong, advancing 11.7% in the 4th quarter as interest rate expectations shifted again based on developing economic data. As you can see in the chart below (Panel B), expectations were that the Fed Funds rate would still be above 5% in June 2024. But, by the end of the quarter, those expectations dropped from 90% probability to 0%. Softer economic data and lower inflation coupled with comments from Federal Reserve chairman Jerome Powell led to the belief that the Fed would begin dropping interest rates in March and throughout 2024. Not only did the U.S. stock market surge, but U.S. bonds rallied as well +6.8% for the 4th quarter.

2023 – Looking Back

For the full year 2023, the U.S. stock market advanced (S&P 500) +26.3%, U.S. small companies (Russell 2000) +16.9%, International Developed (MSCI EAFE) +18.2%, Emerging Markets (MSCI Emerging Markets) +9.8%. Bonds rose for the year as well +5.5% (Barclays US Aggregate) as interest rates retreated.

Inflation measured by the Consumer Price Index (CPI) started 2023 above 6% and finished the year close to 3% which was significant improvement as it approaches the Federal Reserve target of 2%. Additionally, the Fed slowed its pace of interest rate increases and halted them after July as you will see in the chart below (Panel A). Both of these factors coupled with recession avoidance in the economy were positive for stocks and bonds in 2023.

The strong market advance in 2023 and especially the 4th quarter reminds us that returns can surprise quickly at times we least expect it. Forecasters predicted with strong confidence that we would have a recession in 2023. While it is still not out of the question, a recession has not materialized.

Turning the Page

Looking forward to the year ahead, The Fed will try to thread the needle with lowering interest rates at the appropriate time while keeping inflation in check and avoiding a recession. The jobs market remains strong with the unemployment rate at 3.7%, and manufacturing construction spending has been surging. Politics will make the headlines as well with the Presidential election coming in November.

We consistently take a long-term view even though our human nature is to look at the day-to-day. The chart below emphasizes “why we invest” showing the U.S. market (S&P 500) up 793% over the last 30 years vs. the spending power of the U.S. consumer dollar falling 52% due to inflation. Stay the course!

If you would like to discuss or learn more, schedule a call or meeting with me using the link below:

Tripp Yates, CPA/PFS, CFP®

901.413.8659 tripp@eaglestrong.com

Tripp’s passion for financial planning is evident to each and every client he meets with. His desire is to help his clients organize their finances, reduce taxes, and invest wisely. As a fee-only fiduciary advisor, Tripp strives to work in a humble and transparent way.

With extensive experience in financial planning and investment management, Tripp diligently uses his credentials of CPA and CFP® to benefit his clients. Over the last ten years, he has managed over $100 million in assets for individuals and families. In 2017, he founded Eaglestrong Financial, specializing in helping dentists and business owners. Outside of work, Tripp enjoys running, spending time with his family, and cheering on his favorite sports teams. He is an active member of Harvest Church.

References

Investment returns obtained from Kwanti Portfolio Analytics. 10/01/2023 to 12/31/2023. S&P 500 TR = 11.69%. Barclays US Aggregate Bond Index = 6.82%. 01/01/2023 to 12/31/2023 S&P 500 TR = 26.29%. Russell 2000 Index TR = 16.93%. MSCI EAFE Index TR = 18.24%. MSCI Emerging Markets Index TR = 9.83%. Barclays US Aggregate Bond Index = 5.53%.

Avantis Investors Monthly ETF Field Guide December 2023

https://twitter.com/awealthofcs/status/1743289380641313017

https://twitter.com/WinfieldSmart/status/1742530048886759897

https://twitter.com/lisaabramowicz1/status/1743206663543300517

https://twitter.com/charliebilello/status/1742388147760103835

Disclaimer

Eaglestrong Financial, LLC is a Registered Investment Advisor offering advisory services in the states of TN and MS and in other jurisdictions where exempted. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Past performance is no guarantee of future results.

#eaglestrong #eaglestrongfinancial

Share with others: