The 2017 tax filing deadline is approaching on April 17th. If you have extra cash and are looking for last minute tax savings, here are some options to save for retirement or healthcare spending. You must make contributions for 2017 before you complete your filing.

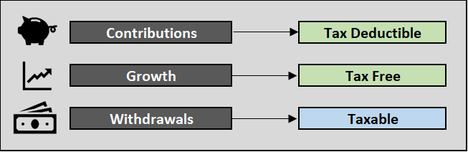

Traditional IRA

You can make a tax-deductible contribution to an IRA up to $5,500 (+$1,000 for those age 50 and older). For someone with a marginal or highest tax rate of 28%, this would reduce their current taxes by $1,540. Keep in mind that if you or your spouse participates in an employer sponsored retirement plan, your ability to deduct the IRA contribution becomes phased-out once you reach certain income levels.

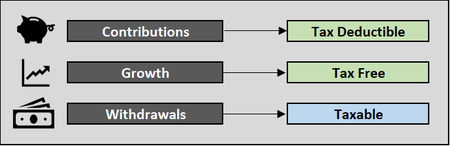

SEP IRA

If you are a self-employed business owner, you can open and make a tax-deductible contribution to a SEP IRA. The maximum contribution for 2017 is the lesser of 25% of your income or $54,000. You must make your contribution before you file your tax return. However, unlike a traditional IRA, you can file an extension through October 15, 2018 if you need extra time to make the contributions.

If you are a business owner with employees, you must contribute to a SEP IRA for your employees with the same percentage of their income as you do for yourself. Because of this, these accounts are mainly used by business owners and independent contractors who do not have employees.

For 2018, if you are a solopreneur you should consider a Solo 401(k) instead of a SEP IRA but it is too late to open this account for 2017 as it must be opened in the calendar tax year.

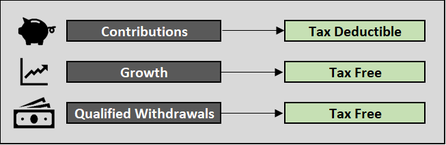

HSA

If you had a high deductible health plan in 2017, you can make tax-deductible contributions to a health savings account (HSA) up until the April 17th tax filing deadline. The maximum contributions for 2017 are $3,400 (self only) or $6,750 (family). The money you set aside in the HSA can be used to pay for qualified medical expenses. An HSA is the only account that has a triple tax benefit. Ensure with your insurance provider that your high deductible health plan is HSA compatible. For more information on health savings accounts, you can read our recent post Triple Tax Advantage.

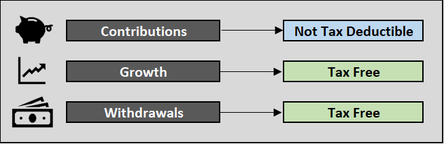

Roth IRA

You have already been levied taxes on the extra cash in your bank account. If you are looking for a future tax benefit, you may want to contribute to a Roth IRA instead of a traditional IRA. For example, maybe your income in 2017 was lower than you think it will be in the future. You can contribute up to $5,500 (+1,000 catchup for those age 50 and older). Even if you or your spouse participate in an employer sponsored retirement plan, you can still contribute directly to a Roth IRA without a phase-out as long as your modified adjusted gross income is below $118,000 (single) or $186,000 (married filing jointly).

If your income is above the limits, you can make a non-deductible IRA contribution and convert it to a Roth IRA. This is called a back-door Roth IRA contribution. Before doing this, you want to be sure you do not have any other IRAs with money in them to avoid taxes on your Roth conversion.

Planning Ahead

Keep in mind as you visit with your CPA or prepare your own taxes for 2017 that the laws are changing for 2018. It is wise to gain understanding of how this will affect your taxes in 2018 so that you can take any necessary actions throughout the year and avoid surprises next April. For a summary of changes, you can read our recent post Key Points from Tax Reform.

Our goal at Eaglestrong is to guide, inspire, and educate our clients to be financially wise.

References

* 2017 Key Numbers – prepared by Broadridge Investor Communication Solutions, Inc.

** https://www.nerdwallet.com/article/ira-contribution-limits

*** https://ttlc.intuit.com/questions/1901514-tax-year-2017-calendar-important-dates-and-deadlines

Disclaimer

Eaglestrong Financial is a Registered Investment Advisor (RIA) with the state of Tennessee. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities.

#eaglestrong #eaglestrongfinancial